Trends

For data-driven stories, to appear under “Trends” menu

Notably, renovators are less likely than they were a year ago to undergo kitchen modifications for the purpose of improving the home’s resale value.

In Miami, the number of coworking spaces rose quarter over quarter in Q4 2023, while the city’s total square footage of coworking space rose too.

At the same time, the median sales price rose 4.4% to $382,600.

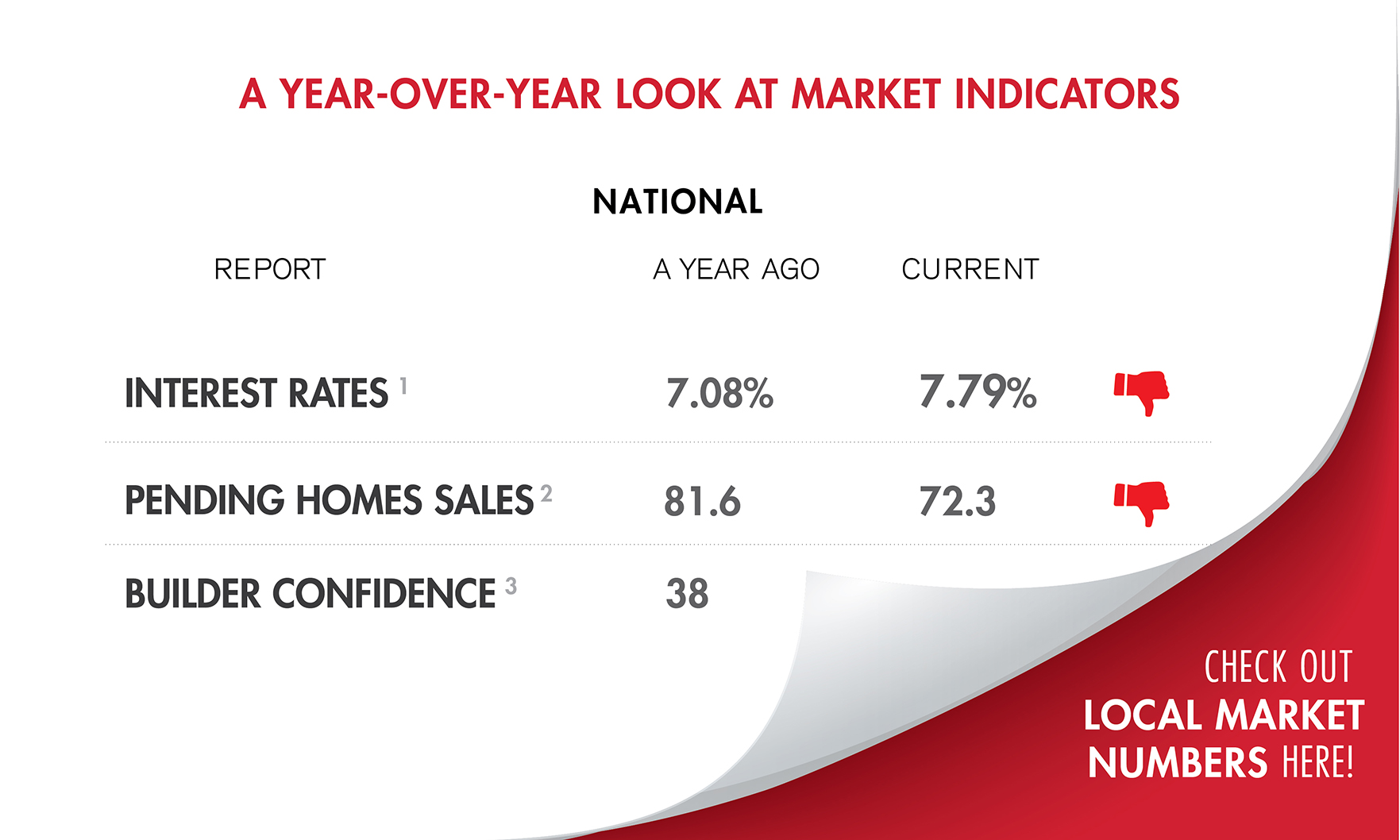

The NAHB/Wells Fargo Housing Market Index (HMI) rose seven points to 44, its second monthly increase in a row.

Nearly all millennials — 93% — say a volatile market is to blame for wrecking homebuying plans, with another 76% saying they expect the market to get worse before they’re able to make a purchase themselves.

CoreLogic expects prices to continue to grow through the year.

How will our homes evolve in the new year?

RentCafe analyzed apartment sizes in ZIP codes across the country to determine which areas give the typical renter the most bang for their buck.

An analysis of Google search data put Miami second only to Dubai as the most desirable relocation possibility for those living outside the U.S.

The only region of the U.S. that didn’t experience an annual decline in existing home sales was the Midwest, where sales were unchanged year over year.

Detached single-family homes remained the most popular type of housing, making up 79% of all home purchases during the past year.

According to a new analysis by PropertyShark, Fisher Island’s 33109 ZIP code is the third-most expensive in the country, with a median home sale price of $5.5 million.

Existing-home sales slid in Miami-Dade, Broward and Palm Beach counties, while days on market and housing inventory were mixed.

The median price of a new home sold during the month fell to $418,800 from $433,100 in August, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

The median existing-home price for all housing types in September was $394,300, up 2.8% from $383,500 in September 2022.

From the beach to the bustling arts scene, Wynwood is one of the trendiest neighborhoods in the country … so how much does it cost to live there?