Current Market Data

Detached single-family homes remained the most popular type of housing, making up 79% of all home purchases during the past year.

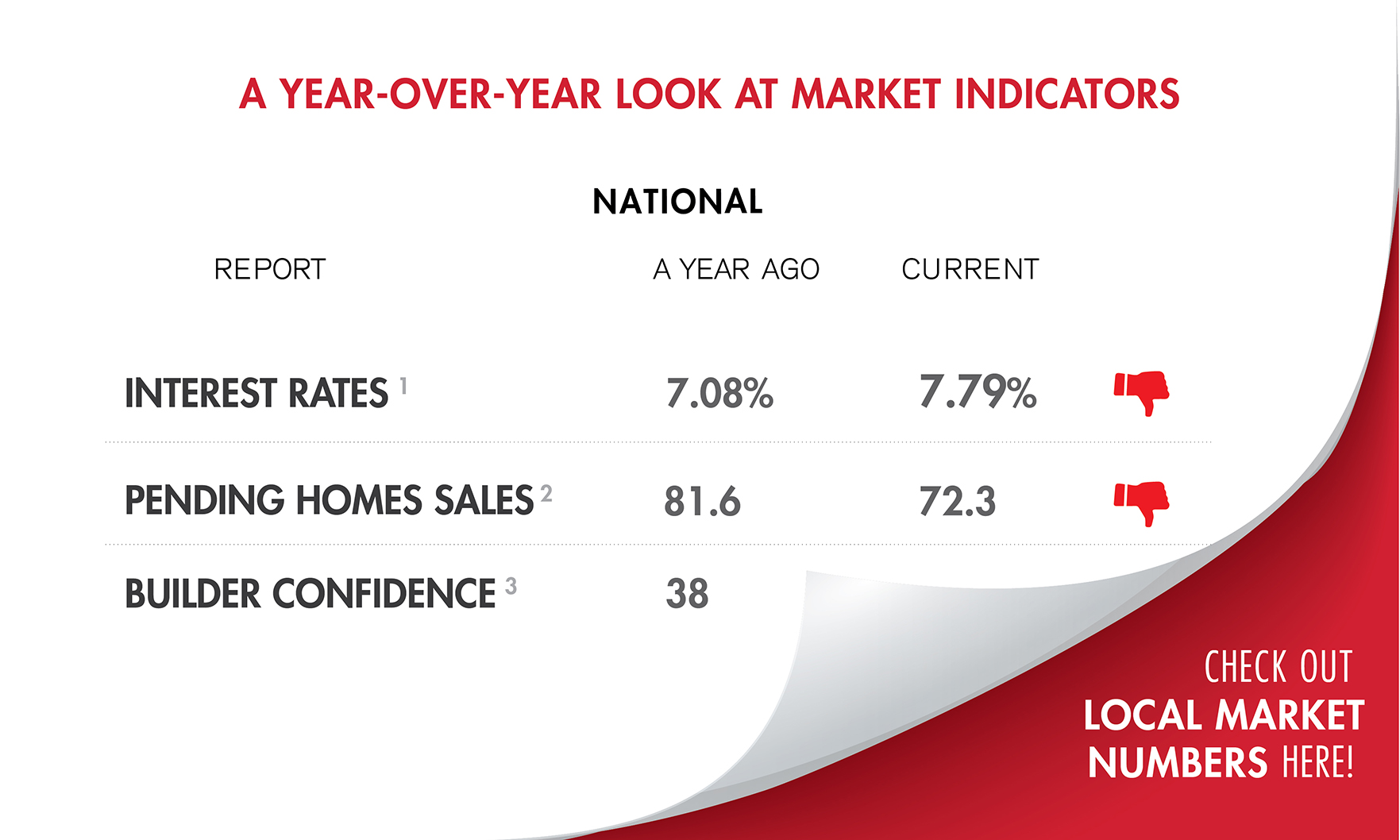

Last month, homebuyer demand showed its resilience, despite mortgage rates being at a 23-year high and inventory continuing to be limited.

According to a new analysis by PropertyShark, Fisher Island’s 33109 ZIP code is the third-most expensive in the country, with a median home sale price of $5.5 million.

A record number of homesellers are dropping their prices as buyers continue to feel the impact high mortgage rates are having on their wallets.

Existing-home sales slid in Miami-Dade, Broward and Palm Beach counties, while days on market and housing inventory were mixed.

The median price of a new home sold during the month fell to $418,800 from $433,100 in August, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

The median existing-home price for all housing types in September was $394,300, up 2.8% from $383,500 in September 2022.

From the beach to the bustling arts scene, Wynwood is one of the trendiest neighborhoods in the country … so how much does it cost to live there?

Specifically, single-family homes were built at a seasonally adjusted annual rate of 963,000, up 3.2% from 933,000 in August and up 8.6% from 887,000 a year earlier, according to government figures.

Brutalist style and sensory gardens may seem at odds — but they are both hot home design trends that will rule 2024. At least, according to new predictions from Zillow.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

New home listings are still on the rise, despite mortgage rates hitting the highest level in more than 20 years. And those high mortgage rates are pushing monthly housing payments higher than they’ve ever been.

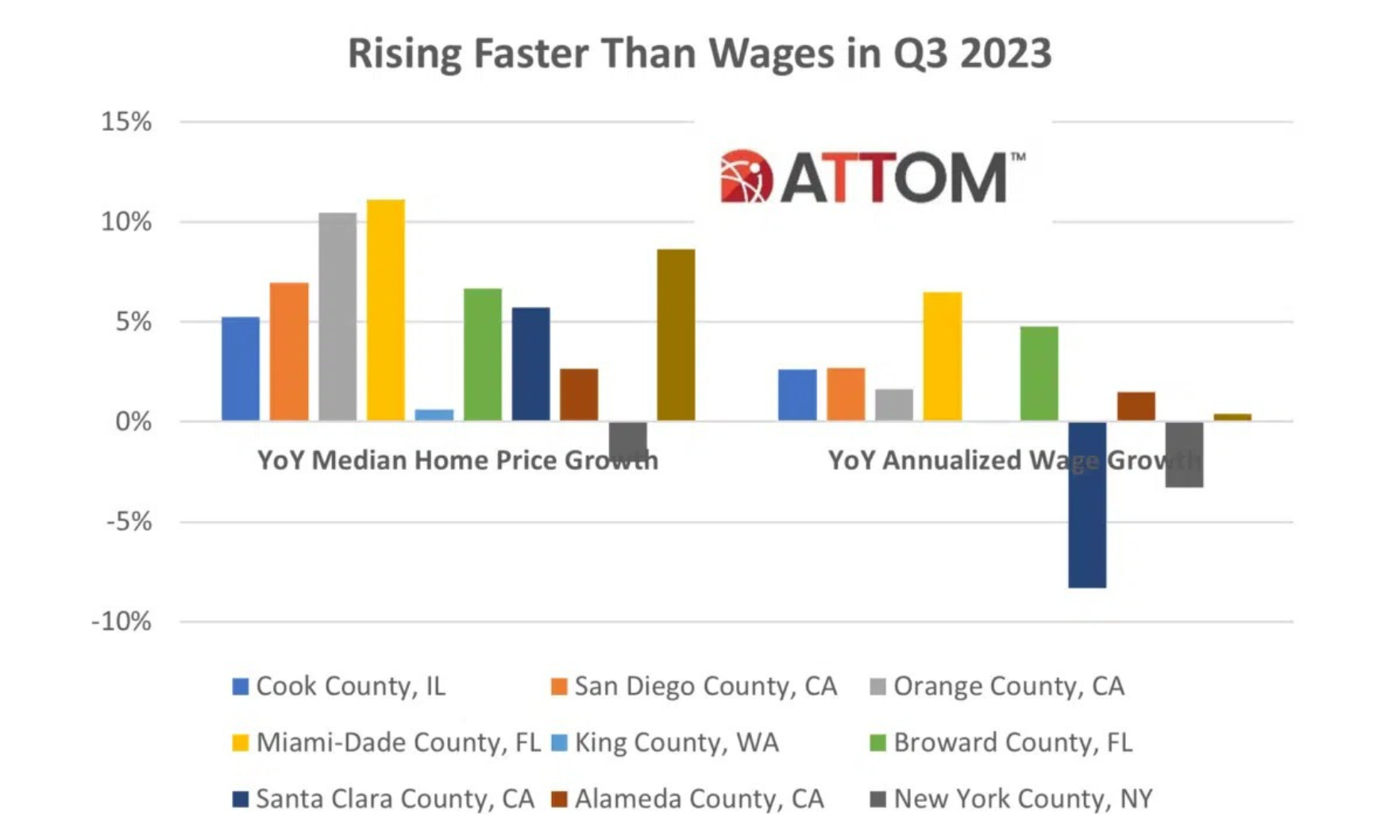

Housing affordability has worsened in many parts of the country as wages fail to grow at the same pace as home prices.

Regionally, pending sales were down across the board on both a monthly and an annual basis, the National Association of REALTORS® said.

Home sales in the $600,000 to $1 million range increased by 15.5% year over year in Miami-Dade County in August.

Among the top upgrades: large showers.