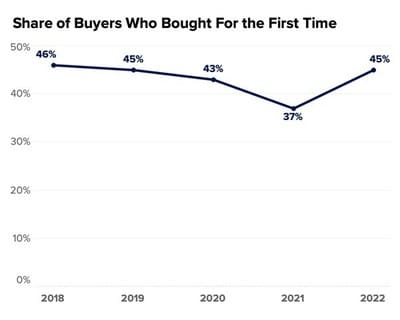

First-time homebuyers now make up 45% of current homebuyers — up 8% year over year — according to new data from Zillow. The numbers represent a rebound from the lows of the pandemic when affordability challenges limited millennial and Gen Z shoppers.

With the pandemic’s high prices and tough competition, younger shoppers lost out to older — often all-cash — buyers. A past survey found that 45% of Gen Z and 38% of millennial buyers lost out to all-cash buyers at least once, compared to 30% of all buyers. But now, Zillow finds, repeat buyers are pulling back due to rising mortgage interest rates. The result is a rebalanced market that’s working in favor of first-time buyers.

“First-time buyers now appear to be making relative gains as high mortgage interest rates disproportionately encourage current homeowners to stay put,” Zillow Population Scientist Manny Garcia said in the report. The slowed flow of homes onto the market seems to confirm this. And though rising mortgage rates affect all buyers, Garcia said, first-time buyers are likely less deterred since rents are also so high.

However, these many first-time buyers still face stiff competition — from one another. Starter homes will be a hot commodity in this shifting market. To help out, Zillow also compiled a list of tips for first-time shoppers, available here.