By the Numbers

Low inventory and high demand are buoying builder sentiment in the face of several headwinds.

The drop in the pace of new-home construction follows a significant surge the month before, according to government statistics.

Despite the declining rate of increase, home prices have risen for the last 136 months, CoreLogic said.

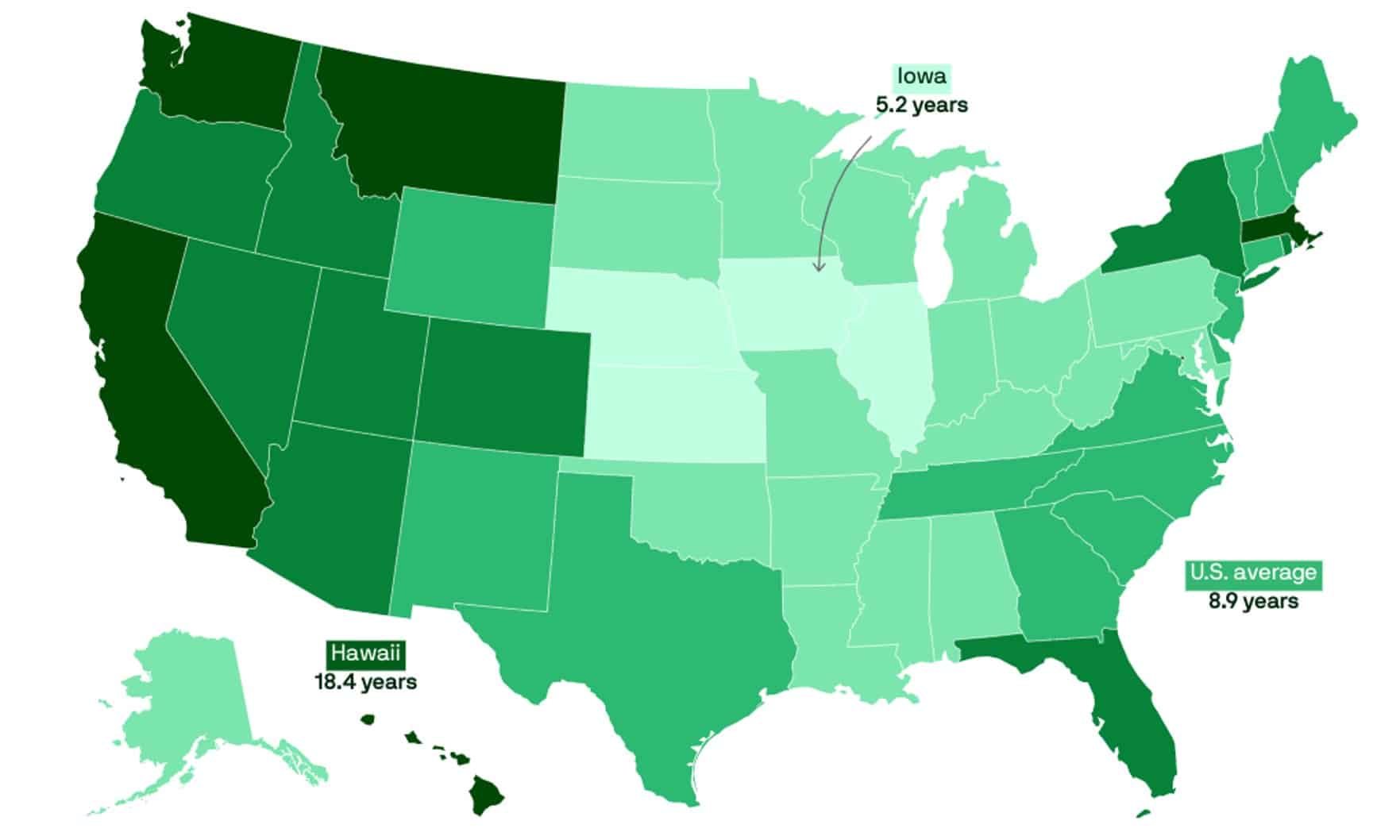

It takes the average Miamian 13 years to save up for a 10% down payment on a home, according to a recent Axios analysis.

Transactions that do go through are typically seeing multiple offers, NAR Chief Economist Lawrence Yun said.

A third consecutive month of increases in the S&P CoreLogic Case-Shiller U.S. National Home Price Index lends new evidence to claims that previous declines could be behind the market.

Demand for newly built homes has remained strong as high interest rates keep many would-be sellers of existing homes off the market.

At the same time, the median existing-home price for all housing types slid 3.1% year over year to $396,100.

The larger-than-expected increase comes as homebuilder sentiment rose for the sixth month in a row.

A second consecutive month of increases in the S&P CoreLogic Case-Shiller U.S. National Home Price Index could indicate a reversal of the negative trend that began last year.

Despite solid demand, a dearth of homes for sale kept transaction numbers muted in the association’s most recent report on pending sales.

A shortage of existing inventory continues to drive buyers to new construction.

Multiple-offer situations have returned with the spring buying season while distressed and forced sales are “virtually nonexistent,” the National Association of REALTORS® said.

Single-family permits also posted a gain, indicating even more new homes are headed to today’s supply-constrained housing market.

Homebuilder optimism was buoyed by continued shortages of new housing inventory, the National Association of Home Builders reported.

Interest rates on mortgages of all types declined last week, spurring an uptick in borrowing, the Mortgage Bankers Association reported.