Nearly three-quarters of all Americans have no regrets about their home purchase or the home purchasing process, according to a new survey from Truehold.

The real estate services company surveyed 2,500 American homeowners that fell into one of four main generation categories: Generation Z (18-26 years old), Millennials (27-42 years old), Generation X (43-58 years old) and Baby Boomers (59-77 years old).

Motivations for homeownership are varied across generations: Gen Z and Boomers made the decision for better living conditions, while Gen X and Millennials were in search of stability they couldn’t get while renting.

When it comes to the biggest hurdles during the homebuying process, Boomers and Gen Z again sided together, citing affordability at the biggest concern. Millennials were most burdened by high interest rates, while Gen X said saving for a down payment was their largest obstacle.

Gen Z, Millennials, and Gen X all agreed that owning a home was the No. 1 sign of financial success. Boomers, on the other hand, ranked the ability to retire at No. 1.

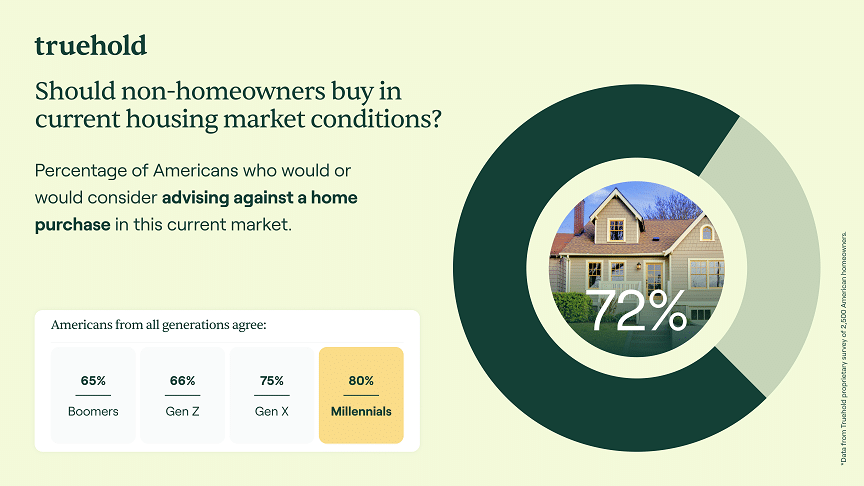

via Truehold

Truehold additionally found that 63% of homeowners feel very positive about owning a home, with Gen Z feeling the most positive at 73% of survey respondents. However, 72% of respondents also agreed that they wouldn’t necessarily recommend purchasing a home to someone else given the current market. A majority of respondents — 69% — also said they’re not sure whether or not the “American Dream” still includes homeownership.

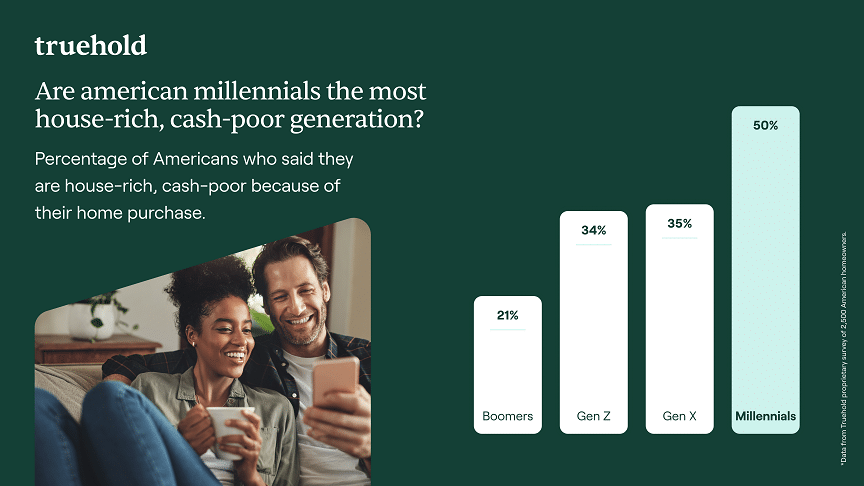

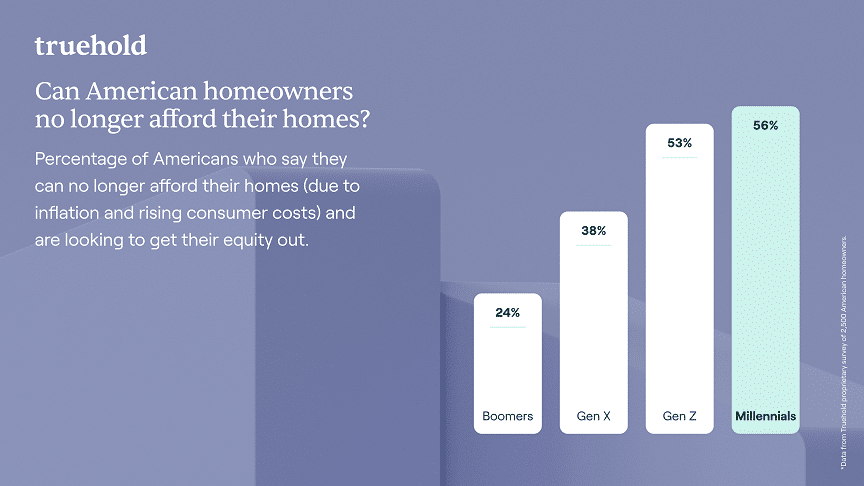

When it comes to the economic struggles of owning a home, 50% of all Millennials surveyed said they feel “house-rich, cash-poor.” This statement only applied to 21% of Boomers, 34% of Gen Z and 35% of Gen X. Millennials were also the most likely generation to share that they no longer can afford their mortgage payments or other related housing costs.

Via Truehold

It’s no surprise then that Millennials were also the generation least likely to purchase their home again if they knew the economic struggles they would face in the future, with 47% expressing that sentiment. Over 80% of Boomers said they would still purchase their home despite the current economy.

Furthermore, 48% of all respondents said they wouldn’t be able to retire without selling their home. When broken down by generation, 39% of Boomers, 47% of Gen Z, 50% of Gen X and 63% of Millennials said they weren’t sure if they’d need to sell their home in order to retire. However, a majority of respondents in all generation groups said they wanted to stay in their homes when they retire, with the highest proportion coming from Gen Z (76%).

Via Truehold

Respondents were also asked what their largest barrier to retirement would be in the future. A majority of Boomers said that preferring not to sell their house would be their main obstacle, while Gen X and Millennials said they simply don’t have enough money saved.

“Throughout the research one thing remains clear: Americans of all ages have a deep desire to stay in their homes well into retirement. A remarkable 71% of respondents expressed their strong preference to age in the comfort and familiarity of their house,” said Truehold Founder and CEO Brian Hardecker. “This highlights the enduring significance of finding housing solutions that enable individuals to navigate economic challenges, like high interest rates and inflation, while maintaining the security and emotional attachment to their beloved homes.”