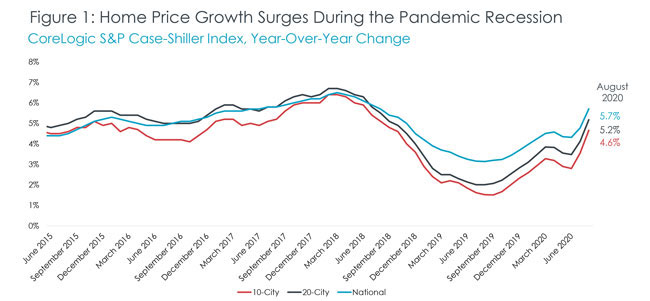

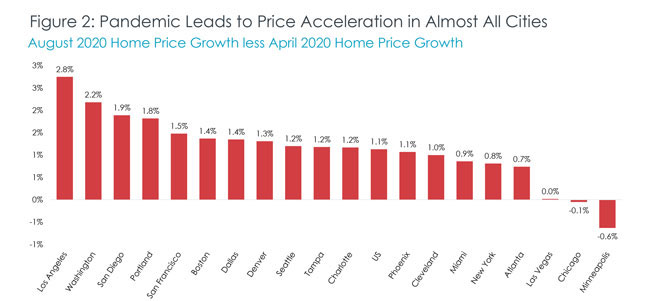

Summer was the new spring for homebuyers, with demand up in August from buyers who delayed their decision to buy because of the COVID-19 outbreak, according to the S&P CoreLogic Case-Shiller Home Price Index.

Demand was also fueled by low interest rates and a growing desire for larger homes and vacation homes. The index soared to a new high in August at 5.71%. It’s the fastest the index has gone up since July 2018.

The index was also up month over month by 1.06%, making it the fastest growth rate since spring 2018. If home sales hold steady through the rest of the year, they will eclipse 2019 levels to become the best year for home sales since 2006.

“The forgone spring home-buying season appears to have fully shifted into summer months, leading to sales volumes that are picking up speed at a time when they would normally show signs of slowing,” CoreLogic Deputy Chief Economist Selma Hepp said in a press release. “Not only was demand fueled by buyers planning on purchasing a home in the spring, but also by those motivated by record-low mortgage rates, desire for a larger home or desire for a vacation home as a result of the pandemic.”

Inventories have fallen 25% below 2019 levels nationwide — a number that reaches as high as 50% in some regions.

Big cities might not be in as much trouble as some think, according to the report, which shows that the index’s 10-city composite — made up of the 10 largest cities in the nation — experienced increases commensurate with the 20-city composite. The 10- and 20-city composites increase 4.66% and 5.18%m, respectively. “Encouragingly, the 10-city index is marching solidly in line with the 20-city index, suggesting demand in the largest metro areas remains strong despite some being hard-hit but the pandemic and notions of urban outmigration,” the report noted.

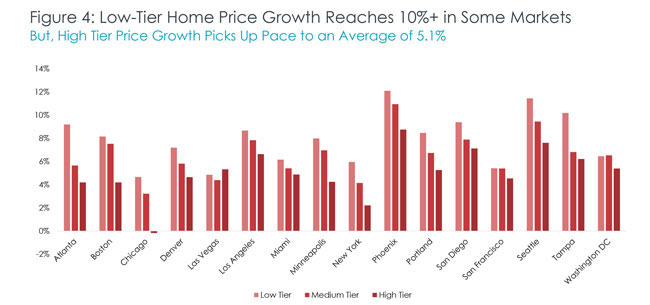

Homes in the lower third of the price distribution were the most competitive, a trend driven largely by millennial buyers. The average annual growth rate was up to 7.8% for the 20-city composite. The average price of homes in the middle tier was up 6.6% and those in the top tier were up 5.1%.

Home prices are expected to increase through autumn, but expect a slowdown in 2021 because of an anticipated dissipation in affordability gains.

First American Financial Corporation released its own August report showing that affordability might have reached a tipping point for the month.

The report shows real house prices up 0.15 percent% for the month but down 5.7% for the year. The ability to buy a home was also up year over year, according to the report, increasing 1.3% for the month and 15.6% for the year.

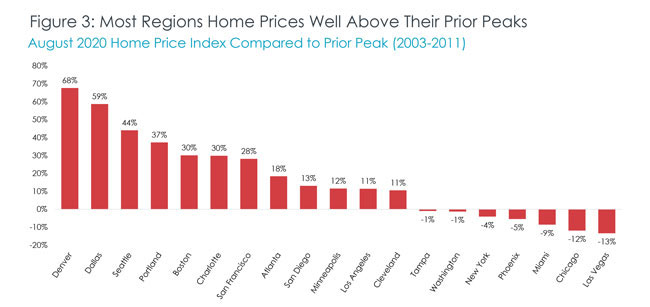

Real house prices are 26.8 percent lower than at the beginning of 2000, and unadjusted house prices rose 15.3% above the 2006 peak.

“Mortgage rates began declining in January 2020 and even dropped below 3 percent for the first time ever in August,” Mark Fleming, chief economist at First American, said in a press release. “But, as mortgage rates have fallen and the housing market has recovered amid strong demand and historically low supply, nominal house price appreciation has rapidly accelerated. In August, the dynamics powering affordability may have reached a tipping point.”