If you’re thinking of buying or renting a property in Miami in the new year, you may want to consult your checkbook first.

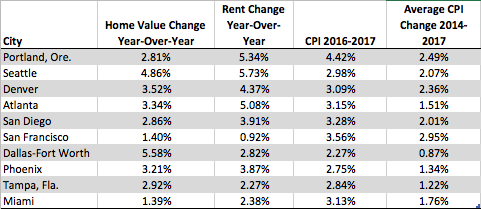

GOBankingRates looked at Zillow’s year-over-year home value and rent forecasts as well as the U.S. Bureau of Labor Statistics’ Consumer Price Index (CPI) to determine which cities will see a spike in living costs in 2018. People in some parts of the country are already struggling to keep up with increasingly high standards of living, such as food costs, rent, utilities and transportation. As a result, homebuyers are feeling the adverse effects and are hesitating to spend big on their next home or apartment rental.

Last summer, Bendixen & Armandi International and the Miami Herald conducted a real estate study of the Miami-Dade area to determine what draws buyers to the market and what scares them away. Even though Miami consistently proves to be a hotspot on homebuyers’ dream cities, the study found that they’re starting to shy away from the high price tags. Miami Beach was voted the most overvalued neighborhood in the county, and prospective homebuyers had complaints about properties being too small for how much they were selling for.

As a result, Miami was one of 10 cities listed where housing prices and living costs are expected to increase the most next year. Zillow predicts that Miami will see a 1.39 percent increase in home value and a 2.38 percent jump in rent. In response, lower- and median-income families are steering clear of purchasing or renting overpriced properties in Miami, with prices expected to drift upward in the coming months.

Source: GOBankingRates