CoreLogic’s March cash sales report found cash purchases are falling dramatically all across the nation

The pool of real estate cash is shrinking as all-cash buyers continue leaving the market, making way for more traditionally financed buyers, particularly first-time buyers, among persisting, widespread inventory shortages, according to a March cash sales report from CoreLogic.

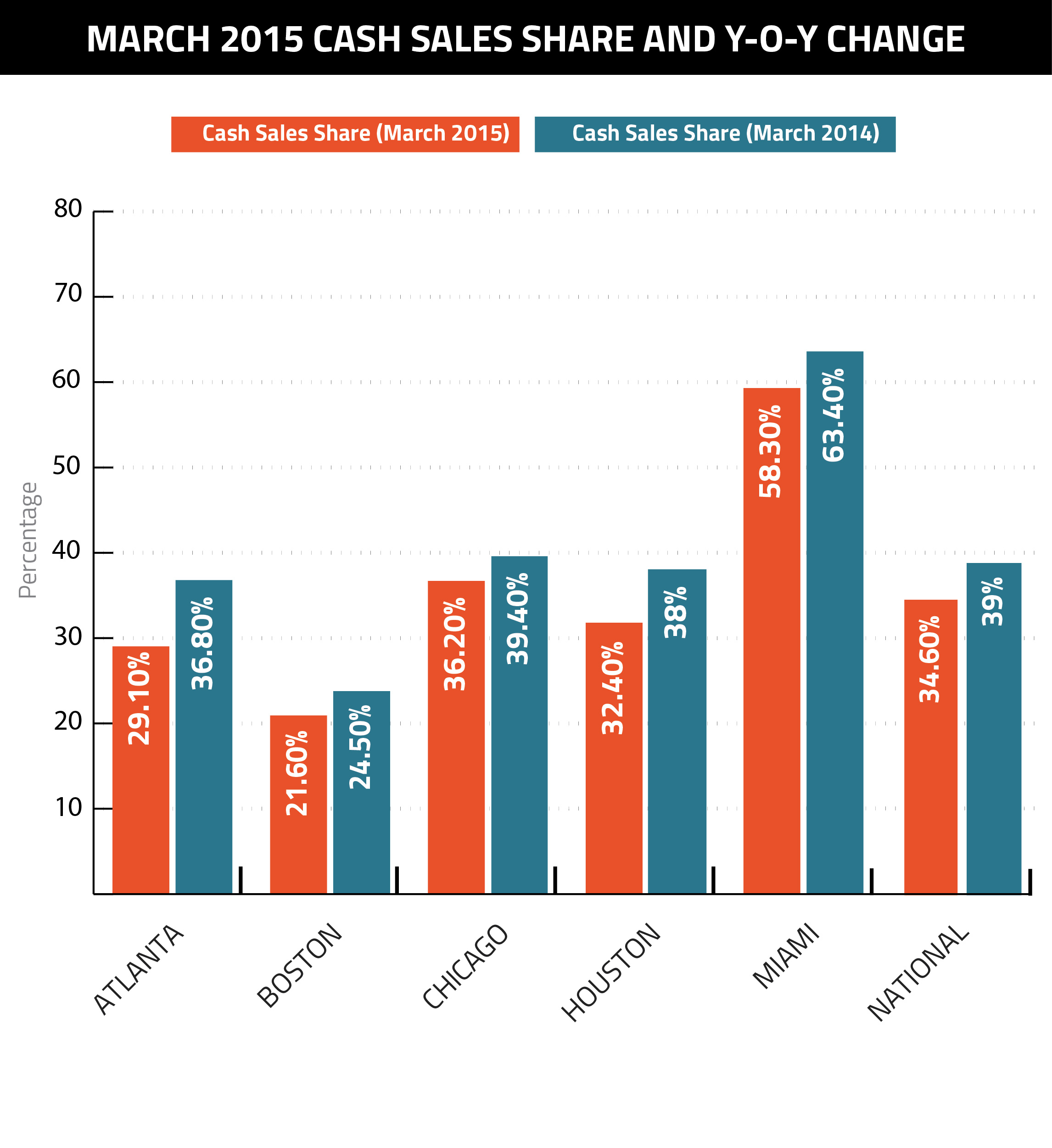

In March, cash sales fell about 5 percentage points year-over-year to 34.6 percent of total home sales nationally. While the drop is a positive note for the industry, it’s not all that surprising. March’s decline is the 27th consecutive month of year-over-year declines, which began Jan. 2013.

Since cash sale hit their peak share in Jan. 2011 at 46.5 percent, their significance in the national market has faded substantially. A large reason for the decline is the drop in foreclosed and distressed properties, which formerly gave investors ample crops of low hanging fruit to pick and flip, as well as a general exodus of all-cash and foreign investors, who’ve left for more immediate returns and less robust currencies.

Nationally, CoreLogic researchers expect cash sales share to hit pre-crisis levels of 25 percent by mid-2016. However, at the metro level, there is a great diversity among markets.

In the Magic City, cash sales continued their descent, dropping year-over-year from 63.4 to 58.3 percent. The fall brings the city closer to the pre-crisis benchmark of 25 percent and reflects persisting currency crises and Europe and Latin America, as well as a strengthening U.S. dollar.

Statewide, March cash sales made up 52 percent of total sales.

Illicit funds to buy property here like the chinese case is clear given their currency control limitations . What control’s does the government (US) including IRS has in place to determine if the money coming in is illicit or not? Wouldn’t we as RE brokers representing this foreign buyers-investors may be participating in some type of money laundering not by taking illicit cash out of the US but the other way around?

Incoming to the US illicit funds from the chinese investors is clear since they have tough currency laws there limited to US$50k per year and the AVG price of their investments is $590k. What control does the US government has (including IRS) to determine if the funds coming in to pay for RE are from an illicit origin? Wouldn’t we as RE brokers be participating in some type of money laundering in some of this cases not by the traditional laundering money out of the US but the other way around? Risky stuff this seems to be…