Lending

The company has also launched a redesign and multi-platform advertising and marketing campaign.

The Low-Income First Time Homebuyers Act (LIFT) establishes a program to sponsor 20-year mortgages that would build equity at twice the rate of a conventional 30-year mortgage.

“The net result for housing is that these low and stable rates allow consumers more time to find the homes they are looking to purchase,” Freddie Mac Chief Economist Sam Khater said.

Two of the largest leaders in the real estate market are joining forces to form a new mortgage origination company.

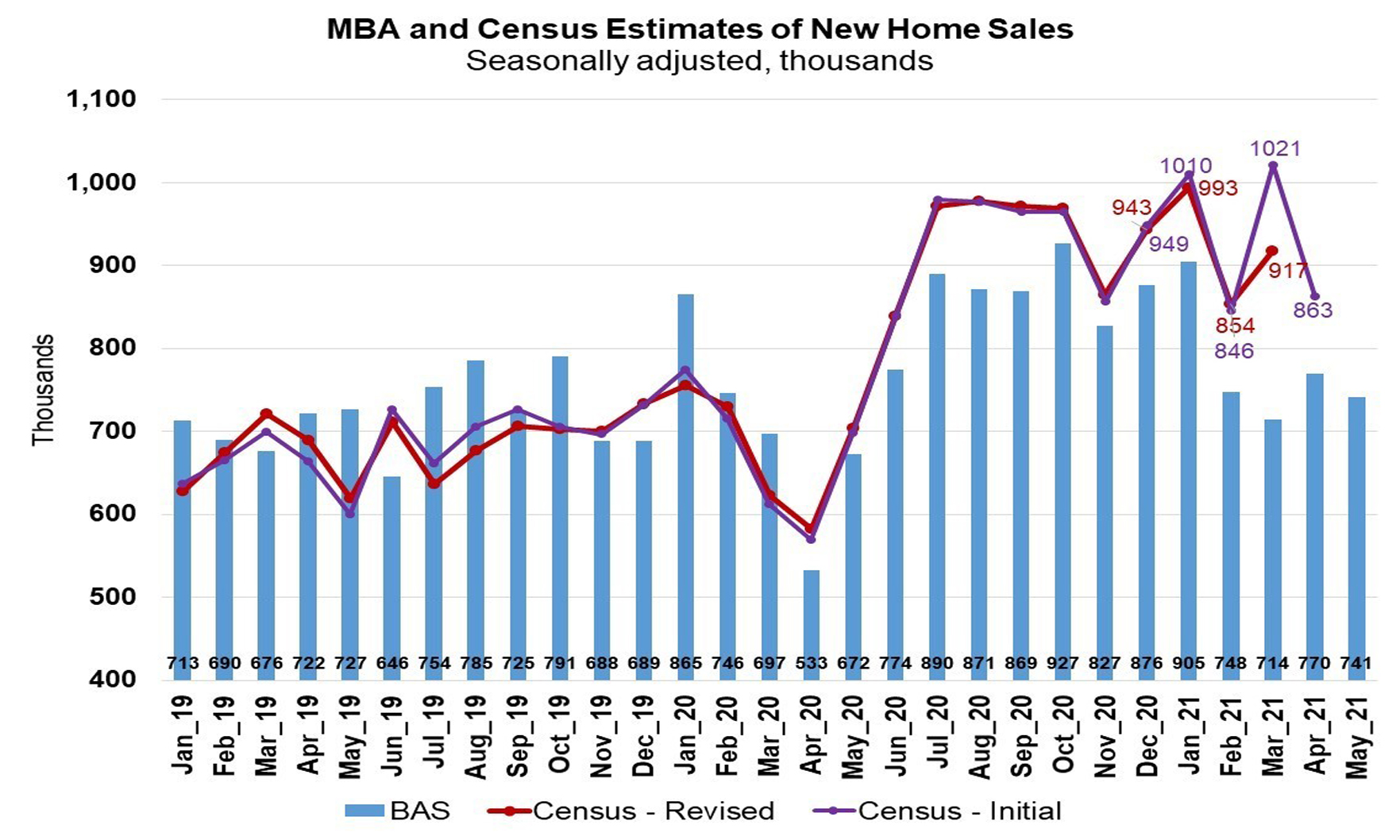

Mortgage applications for new-home purchases fell 9% on a monthly basis and 5.9% on a year-over-year basis in May, the Mortgage Bankers Association reported, citing its Builder Application Survey.

Homebuyers lucky enough to win a bidding war for a property are increasingly running headlong into appraisals that don’t match — or even come close to — the agreed sales price, leaving them with limited ways to close the sale.

“This is a sign that the competitive purchase market, driven by low housing inventory and high demand, is pushing prices higher and weighing down on activity.” — Mortgage Bankers Association Associate Vice President of Economic and Industry Forecasting Joel Kan

The new technology streamlines workflow in the mortgage industry.

The ad is part of their national brand campaign, Believe You Will, which encourages the power of positive thinking and believing you can accomplish your goals.

This means homebuyers will be able to borrow up to the new level without triggering higher interest rates.

Both the way appraisers approach their work and the adoption of AVMs and other technology-based valuations will likely see major changes in the coming years, according to experts.

Some homeowners worry that, after a few months of forbearance, they’ll be required to pay everything they owe upfront, in one lump sum.

Small business owners could help keep their businesses running through a combination of Paycheck Protection Program loans and private loans.

But beware of the busy times: Customer satisfaction rates drop when loan volume increases.

A new bill introduced earlier this week aims to change long lender delays with short

The Federal Housing Administration (FHA) today announced a new modified version of its Home Equity Conversion Mortgage (HECM) product. The HECM loan is a reverse mortgage insured by the federal government. It allows older home owners to tap into