Lending

The 30-year fixed-rate inched to 6.42%, which is still close to the lowest rate in a month, the group said.

The pace of new single-family home sales, meanwhile, fell 6.1% from September to 598,000.

The largest single-week decline in conventional mortgage rates since July brought the first increase in home-loan applications since September, the Mortgage Bankers Association said.

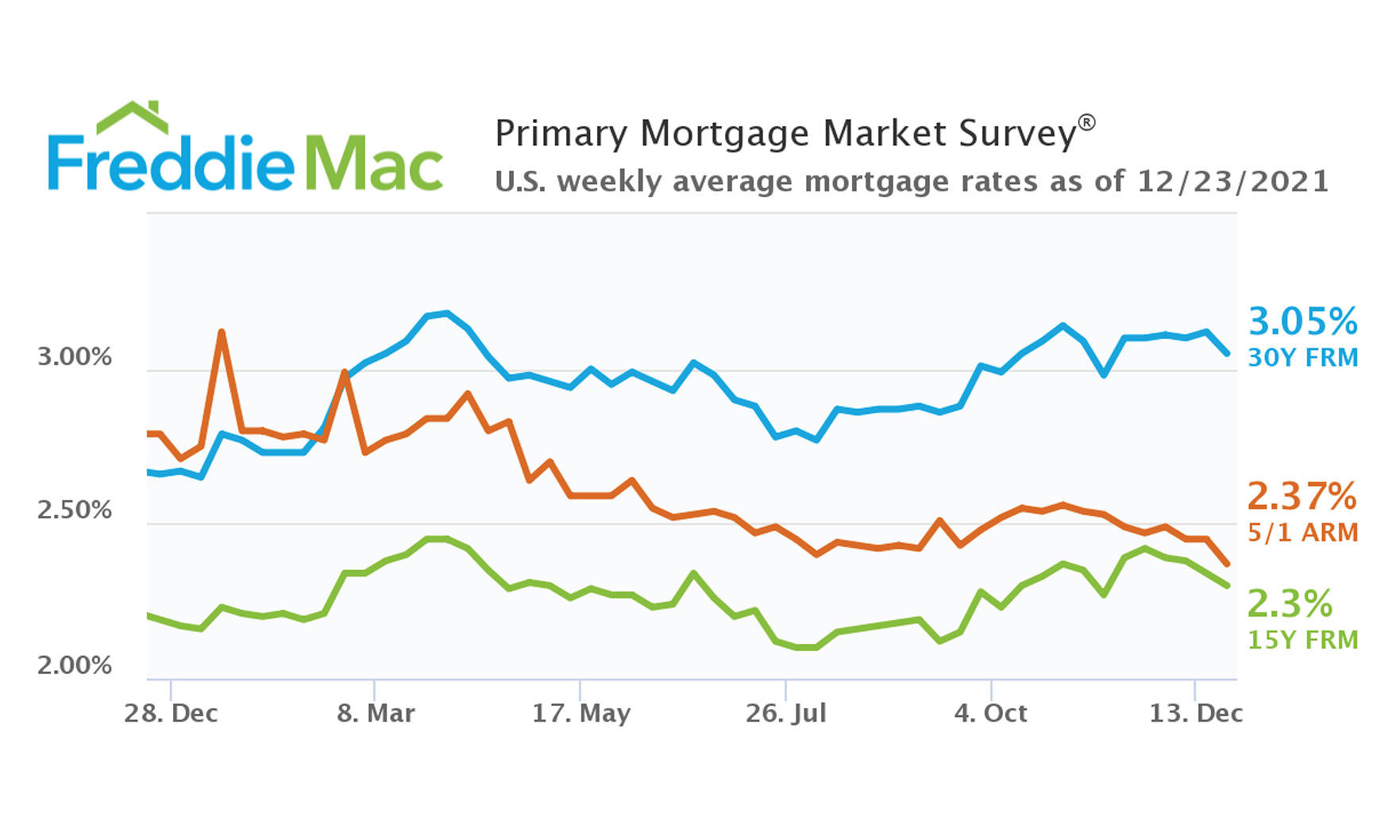

A 30-year fixed-rate mortgage rose to 7.08% this week from 6.94% a week ago, Freddie Mac reported. A year ago, the average mortgage carried a 3.14% rate.

At the same time, mortgage applications declined 1.7% on a seasonally adjusted basis on a week-over-week basis, according to the Mortgage Bankers Association.

Mortgage applications declined 1.2% during the week ended Sept. 9, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Worsening affordability challenges are affecting first-time homebuyers

Despite a slow start to the spring homebuying season, prospective buyers are showing some resiliency in the face of higher mortgage rates, as seen by two weeks in a row of increasing loan applications.

Overall mortgage-application volume was at its lowest level since 2018, the Mortgage Bankers Association said.

“Investors are weighing the impacts of rapidly increasing inflation in the U.S. and many other parts of the world against the potential for a slowdown in economic growth due to a renewed bout of supply-chain constraints.” — MBA associate vice president of economic and industry forecasting Joel Kan

“Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates.” — MBA associate vice president of economic and industry forecasting Joel Kan

Mortgage applications fell more than 13% in the most-recent week tracked by the Mortgage Bankers Association’s Market Composite Index, while interest rates continued to rise.

The average contract interest rate for 30-year fixed-rate mortgages backed by the Federal Housing Administration increased to 3.93% from 3.86%, the Mortgage Bankers Association said.

“MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand,. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.” — Mortgage Bankers Association associate vice president of economic and industry forecasting Joel Kan

At the same time, the average 30-year fixed-rate mortgage rose to 3.33%, its highest level since April 2021, the Mortgage Bankers Association said.

Fears of an economic fallout are causing long-term U.S. mortgage rates to fall as the newest COVID-19 strain reignites worry among Americans.