Trends

For data-driven stories, to appear under “Trends” menu

Month over month in September, existing-home sales slid 1.5% to 4.71 million, which is 23.8% lower than the year before.

New home construction missed analyst estimates in September, falling 8.1% month over month to an annual rate 1,439,000 homes, according to government statistics.

The median price for a home in the Miami area in September was $599,000, an increase of 28.3% compared to the same month last year.

Approximately 58% of homebuyers say they’d be willing to purchase a haunted house — and nearly 25% think they already have.

Looking ahead, CoreLogic expects the year-over-year pace of home-price appreciation to slow to 3.5% by August 2023.

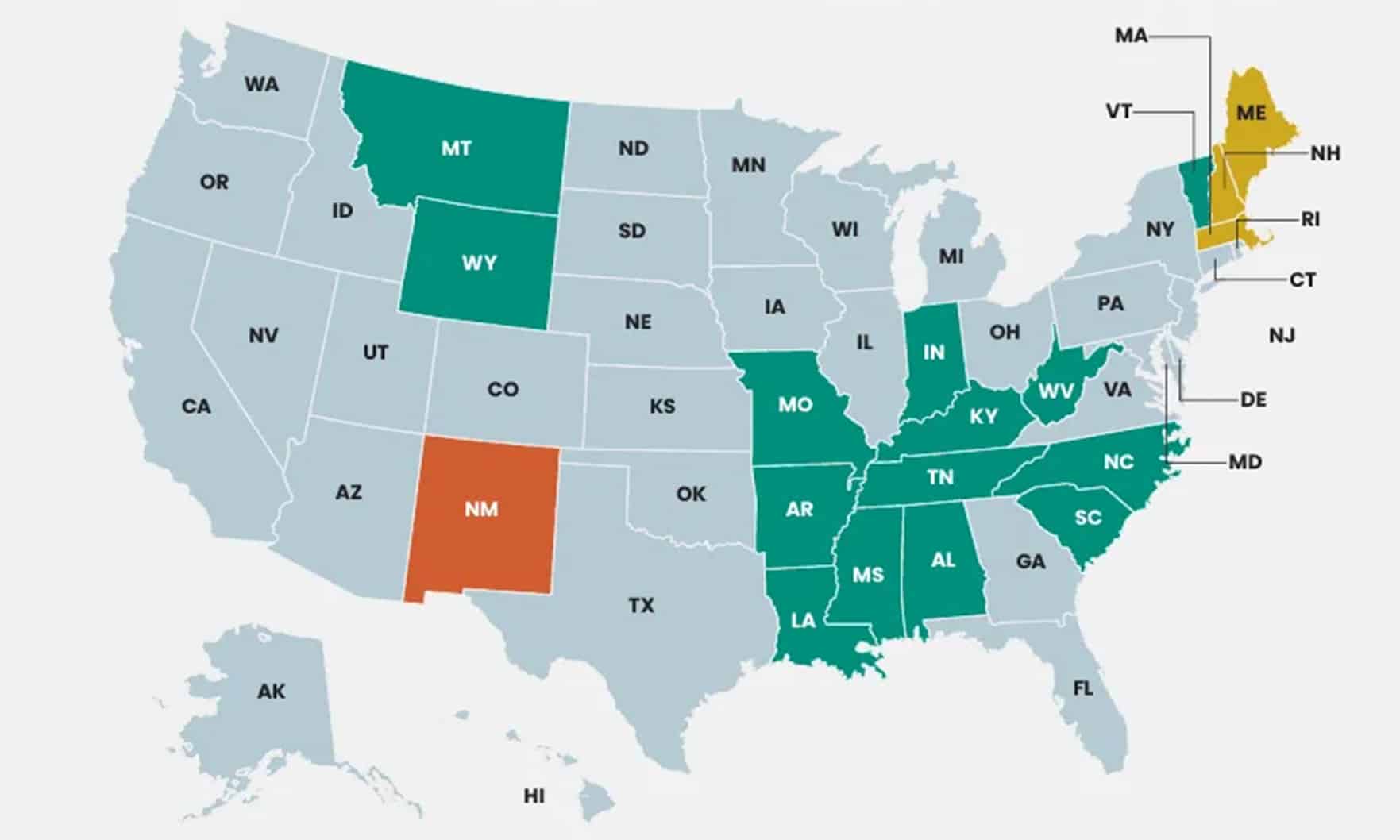

The average median home size varies drastically across the country, according to American Home Shield’s 2022 American Home Size Index.

While 23% of residential Realtors claim they have feared for their safety while on the job, 98% reported that they have never been the victim of a crime while at work.

Sales of new homes in the U.S. jumped 28.8% between July and August, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Miami had one of the highest ratios of people moving in vs. those moving out during the first half of the year, a recent analysis found.

The median existing-home price for all housing types in August was $389,500, a 7.7% rise from the year before.

The NAR’s Community Aid and Real Estate (CARE) Report shows that REALTOR® associations donated a median of $12,070 this past year, a 20% increase over 2020.

New-home construction posted a 12.2% month-over-month increase in August, thanks in large part to a significant jump in multifamily building.

A continuing combination of increased interest rates, supply-chain disruptions and high home prices has sapped homebuilder sentiment every month this year.

Mortgage applications declined 1.2% during the week ended Sept. 9, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Modern homes are still the most popular interior design style, according to a new study from Confused.com, a financial services comparison website based in the U.K.

The modest 1% decline could indicate the current housing cycle is reaching a bottom as mortgage rates recede from their recent high, the National Association of REALTORS® said.