By the Numbers

At the same time, mortgage applications declined 1.7% on a seasonally adjusted basis on a week-over-week basis, according to the Mortgage Bankers Association.

In Miami, home prices posted a 28.6% year-over-year gain in August — the largest in the country — compared to a 31.7% gain in July. Month over month, prices fell 0.1%.

Month over month in September, existing-home sales slid 1.5% to 4.71 million, which is 23.8% lower than the year before.

New home construction missed analyst estimates in September, falling 8.1% month over month to an annual rate 1,439,000 homes, according to government statistics.

Looking ahead, CoreLogic expects the year-over-year pace of home-price appreciation to slow to 3.5% by August 2023.

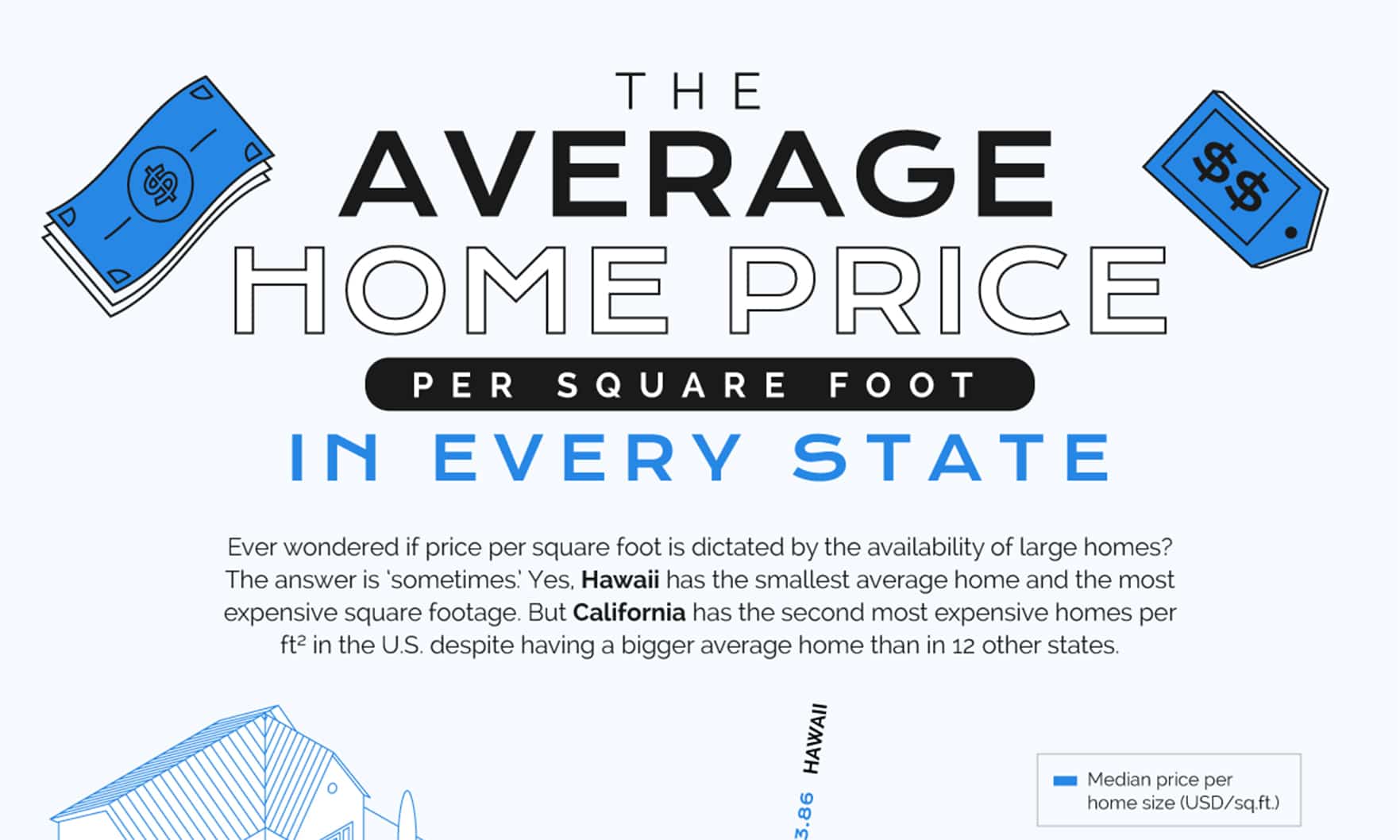

The average median home size varies drastically across the country, according to American Home Shield’s 2022 American Home Size Index.

Sales of new homes in the U.S. jumped 28.8% between July and August, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

The median existing-home price for all housing types in August was $389,500, a 7.7% rise from the year before.

New-home construction posted a 12.2% month-over-month increase in August, thanks in large part to a significant jump in multifamily building.

A continuing combination of increased interest rates, supply-chain disruptions and high home prices has sapped homebuilder sentiment every month this year.

Mortgage applications declined 1.2% during the week ended Sept. 9, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

The modest 1% decline could indicate the current housing cycle is reaching a bottom as mortgage rates recede from their recent high, the National Association of REALTORS® said.

The median price of a new home sold during the month was up 5.9%, however, according to figures from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Nationally, the median sales price slid 2.9% from June but rose 8.1% from July 2021, while closed transactions were down 16.6% on a monthly basis and 26.3% on a yearly one, RE/MAX said in its National Housing Report.

A recent decline in mortgage rates could return some purchasing power to buyers going forward, National Association of REALTORS® chief economist Lawrence Yun said.

The pace of housing starts for both single-family and multifamily residences was down on a month over month basis, the U.S. Department of Housing and Urban Development reported.