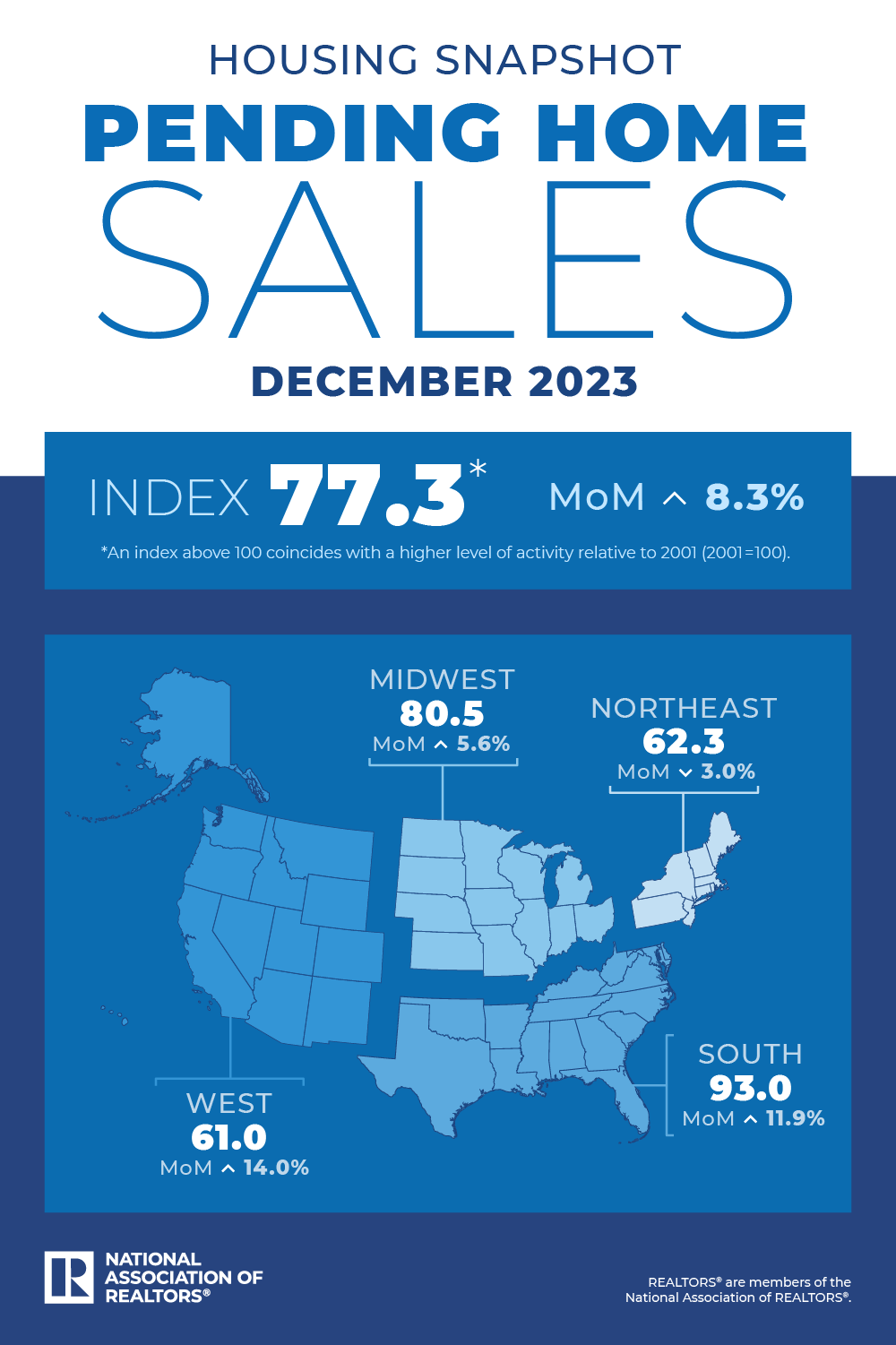

Pending home sales jumped 8.3% from November to December as mortgage rates continued to decline, the National Association of REALTORS® said, citing its Pending Home Sales Index.

Pending home sales jumped 8.3% from November to December as mortgage rates continued to decline, the National Association of REALTORS® said, citing its Pending Home Sales Index.

Pending sales, in which the contract has been signed but the transaction has not closed, are considered a leading indicator and generally precede existing-home sales by a month or two. Year over year, sales were up 1.3%.

“The housing market is off to a good start this year, as consumers benefit from falling mortgage rates and stable home prices,” NAR Chief Economist Lawrence Yun said in a press release. “Job additions and income growth will further help with housing affordability, but increased supply will be essential to satisfying all potential demand.”

The monthly increase was the largest one since 2020 and was well ahead of the consensus estimate of a 2% gain, First American Deputy Chief Economist Odeta Kushi said in a release.

“Consensus projections always seemed on the low side given what we’ve seen with mortgage applications, another leading indicator of sales activity,” Kushi added. “Average mortgage applications in December increased nearly 8% compared with the previous month, and so far in the month of January have increased approximately 10% compared with December. A simple analysis based on the historical relationship between mortgage applications and existing-home sales indicates that existing-home sales should accelerate.”

The better-than-expected increase follows similar outperformance in December new-home sales, which jumped 8% to 664,000, compared to the consensus expectation of 649,000.

Regionally, pending sales were up in the West, South and Midwest, with big month-over-month increases in the West and South, while sales declined in the Northeast.

“Reading between the numbers on pending home sales shows that many American consumers emerged from the pandemic with strong credit scores and remain in a good position to buy a home,”CoreLogic Chief Economist Selma Hepp told Agent Publishing. “However, they are also aware that market fundamentals make it somewhat of a challenge to purchase. Prices remain strong and that won’t change, recent reductions in the mortgage interest rates, however, are helping to drive the desire to buy.”

Looking ahead, NAR expects existing-home sales to rise 13% year-over-year in 2024 and another 15.8% in 2025. The association also expects the median home price to rise 1.4% to $395,100 in 2024, and then increase 2.6% to $405,200 in 2025. Finally, NAR expects the Fed to cut rates four times this year, with the 30-year fixed rate ranging between 6% and 7% for most of the year.