Fears of an economic fallout are causing long-term U.S. mortgage rates to fall as the newest COVID-19 strain reignites worry among Americans.

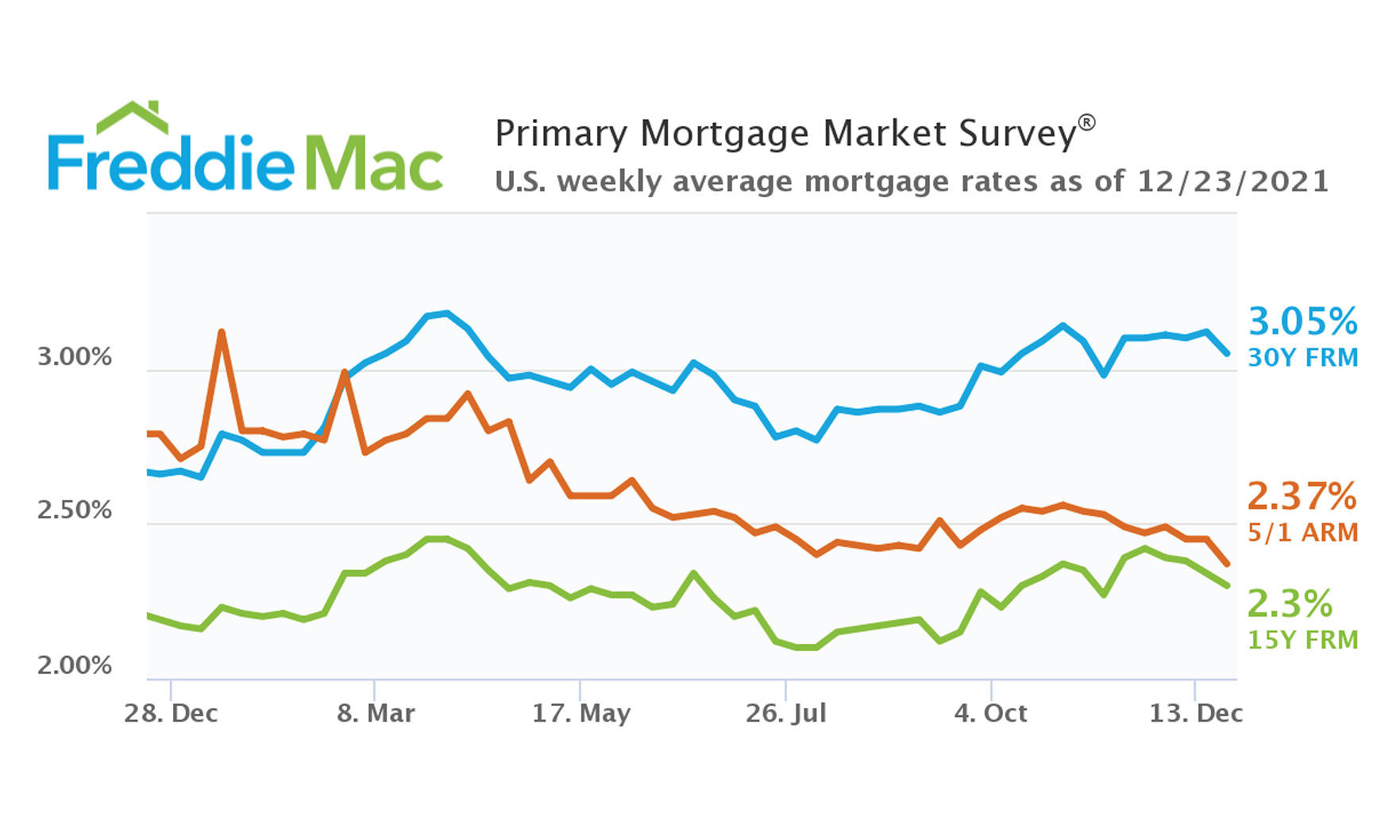

The average rate on the benchmark 30-year fixed-rate mortgage dipped to 3.05% for the week ended Dec. 23, down from 3.12% the previous week, according to Freddie Mac’s Primary Mortgage Market Survey. The 30-year fixed-rate mortgage averaged 2.66% during the same period in 2020.

Fifteen-year fixed-rate mortgages fell to 2.3% from 2.34% last week.

Rates fell despite unusually high inflation because financial markets are worried that Omicron will weigh on economic growth by forcing lockdowns and cancellations.

“The market volatility resulting from the COVID-19 Omicron variant is causing mortgage rates to decrease,” said Sam Khater, chief economist for Freddie Mac. “As the year comes to a close, the housing market is proceeding steadily. However, rates are expected to increase in 2022, which will impact home-buyer demand as well as refinance activity.”