The National Association of Realtors predicts that 2022 will bring slowing inflation, multiple Fed interest-rate hikes and a more measured pace of home-price growth.

More than 20 leading economic and housing experts surveyed by NAR expect the Federal Reserve to raise the federal funds rate by two separate 0.25% turns in order to slow the pace of inflation next year. The industry observers also expect to see home-price growth slow from the gangbuster pace it has enjoyed over the last year or so.

Specifically, the group of experts predicted annual median home prices will increase by 5.7%, and inflation will rise 4%, both representing slower gains than those seen in 2021, according to findings released at the organization’s third annual year-end Real Estate Forecast Summit.

“Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,” NAR chief economist Lawrence Yun said. “Though forecasted to rise 4%, inflation will decelerate after hefty gains in 2021, while home-price increases are also expected to ease, with an annual appreciation of less than 6%. Slowing price growth will partly be the consequence of interest rate hikes by the Federal Reserve.”

Yun expects the U.S. GDP to grow at its typical historical pace of 2.5%, assuming no major disruptions from the omicron COVID-19 variant. He also expects the 30-year fixed mortgage rate to increase to 3.5%, as the Fed raises interest rates to control inflation. He noted, however, that his predicted rate is lower than the pre-pandemic rate of 4%.

While the 2021 housing market performed better than it has in 15 years, with an estimated 6 million existing-home sales, Yun expects sales to dip to 5.9 million in 2022. He also forecast housing starts to rise to 1.67 million, as the pandemic’s supply-chain backlogs are eased.

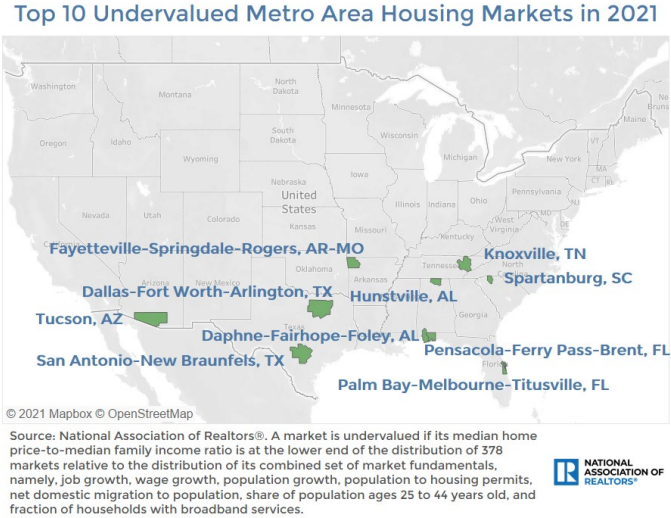

Also at the summit, the NAR unveiled its top 10 housing-market “hidden gems” for 2022. Homes in these markets are expected to see higher price appreciation relative to other markets during the year. In alphabetic order, the 2022 hidden gems are:

- Dallas-Fort Worth, Texas

- Daphne-Fairhope-Farley, Ala.

- Fayetteville-Springdale-Rogers, Ark.-Mo.

- Huntsville, Ala.

- Knoxville, Tenn.

- Palm Bay-Melbourne-Titusville, Fla.

- Pensacola-Ferry Pass-Brent, Fla.

- San Antonio-New Braunfels, Texas

- Spartanburg, S.C.

- Tucson, Ariz.

“The housing sector performed spectacularly in 2021 in many markets, with huge gains achieved in places like Austin, Boise and Naples,” Yun said. “Several markets did reasonably well in 2021, but not as strong as the underlying fundamentals suggested. Therefore, in 2022, these ‘hidden gem’ markets have more room for growth.”

NAR’s full report on 2022 predictions can be found here.