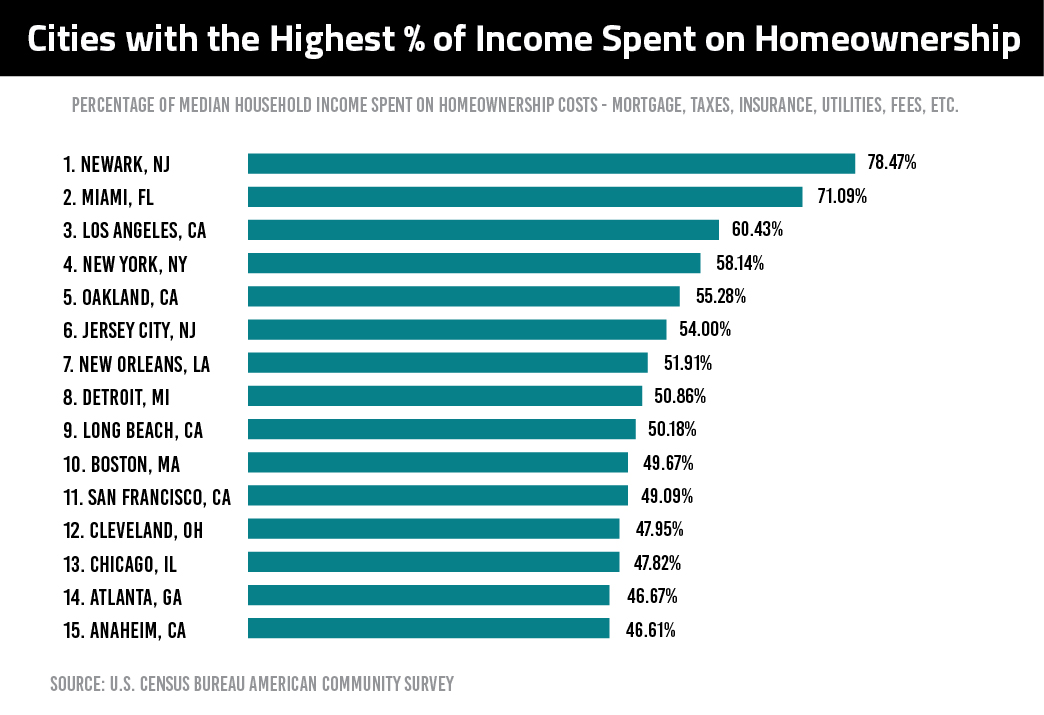

Earlier this week, Estately Blog released its rankings of U.S. cities by percentage of income spent on owning a home. Miami was named No. 2.

In recent years, the Magic City has taken on new life, with huge jumps in condo building and high home price appreciation helping to define the market. The city has long been an international hub, but it has only recently established itself as a truly international city. The market’s promise has proven so potent that the city is among the top 5 nationwide for attracting both domestic investors and international buyers.

However, the increased attention has come at a cost – namely, home price. Many experts now consider the market overvalued, and Estately Blog’s report reflects those challenges.

To become a Miami homeowner – in average terms and including mortgage, taxes, insurance, utilities fess, etc. – requires 71 percent of a person’s annual income. It’s a less daunting percentage than in Newark, where homeownership demands more than 75 percent of one’s income, but still considerable relative to the rest of the country. In some places, like Fort Wayne, Ind., homeownership costs average no more than 26 percent of a person’s income.

See how our city compares to the other top 15 metros below: