Miami Beach

East of the city, Miami Beach has long been a hotbed of sales activity, but the residential market slipped in the first three months of 2016, with median sales price dropping 6.6 percent year-over-year to $408,750 (which might actually be a good thing if you believe the city is overvalued) and overall transactions dropping 21 percent. The silver lining is that inventory is up 32.5 percent from Q1 2015; the bad news is it’s mostly from condos.

Even more condos

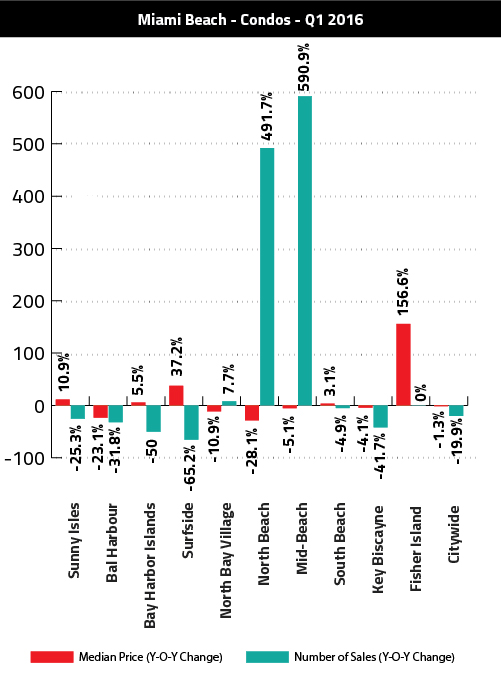

Miami Beach gained 30.4 percent more condos in Q1 2016, which helped to drive median sales price down 1.3 percent year-over-year; a boon in a market where the median condo costs nearly $400,000. Improved inventory was less a complement for sales, which dropped about 20 percent from Q1 2015.

For higher-end condos in Miami Beach, it was another instance of rising median price (up 2.4 percent year-over-year), rising inventory (up 57.7 percent) and plummeting sales (down nearly 19 percent) and demand, denoted by the steep increase of days on market – which jumped from 60 to 119.

More good news for single-family luxury

The pace of purchase fell with the swell of inventory in Miami Beach’s single-family market, as days on market jumped from 61 in the first quarter of last year to 71 this year, while inventory increased 9.7 percent. Median sales price for the property type benefited from a sizeable 14.5 percent jump (pushing the price to $307,250) but demand, again, failed to keep pace, with sales dropping 15.3 percent.

Miami Beach’s luxury single-family market proved more stable than its general counterpart, as high-end homes saw a 10.1 percent year-over-year increase in median price (now at $1.375 million) and a 15.2 percent increase in sales.

We are in a market correction: http://www.miamirealestateguy.com/spring-2016-correction-in-the-miami-real-estate-market/