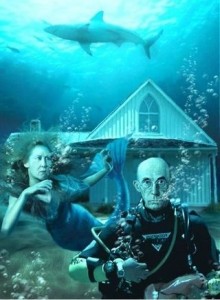

Principal write downs have been labeled a possible solution to underwater mortgages, but the FHFA has resisted.

The Federal Housing Finance Administration and its Acting Director, Edward DeMarco, have been receiving some considerable heat from analysts and members of Congress for their refusal to consider principal write downs for homeowners with Fannie Mae and Freddie Mac distressed mortgages.

In its defense (and response to a Congressional threat to subpoena), the agency has released the findings of a 2010 study on principal write downs that concluded such a program would cost Fannie and Freddie more than $100 billion; and with both GSEs under public receivership, those funds would be collected from taxpayers.

Conducted by several directors at the FHFA, the consensus was not entirely against a principal write down program, according to HousingWire’s Jon Prior, who obtained a copy of the study.

“Interestingly, some key team members believed principal reduction would be effective, and approached the task from the perspective of how to demonstrate that such a measure would reduce losses at the GSEs and help to realign the outstanding mortgage debt and home values,” the report stated.

In short, the study used the same net-present-value test as the Home Affordable Modification Program and attempted to see what the benefit would be in reducing the principal on the roughly 10 percent of GSE loans that are under water.

The directors concluded, according to Prior, that forbearance would be a less costly alternative for the FHFA to pursue, contrary to what Fitch Ratings concluded last week.

“Forbearance, comparatively, showed marginally lower losses,” Prior wrote. “It also creates greater cashflow to investors and is easier on the balance sheet when it comes to accounting. If principal reduction is granted to performing loans — which GSE accountants have not reserved for — the losses would be immediate. Principal forbearance, the analysts concluded, creates no additional accounting losses and allows the GSEs to recover the principal at some later point.”

In a letter last Friday to Elijah Cummings, a Democratic representative from Maryland, DeMarco said that, given the projected cost of a principal write down program, the FHFA would need congressional approval.

“Given that any money spent on this endeavor would ultimately come from taxpayers and given that our analysis does not indicate a preservation of assets for Fannie Mae and Freddie Mac substantial enough to offset costs, an expenditure of this nature at this time would, in my judgment, require congressional action,” DeMarco stated in his letter.

Interestingly, Prior does point out that two other recommendations of the report – that greater forbearance be allowed and that the Home Affordable Refinance Program be retooled – have since been implemented.