The Special Inspector General for the Troubled Asset Relief Program (SIGTARP) released an audit this week that criticized the Department of the Treasury and Florida Housing Finance Corporation over their management of a controversial, billion-dollar program aimed to keep struggling families in their homes.

In 2010, Congress approved a large foreclosure prevention program known as the Housing Finance Agency Innovation Fund for the Hardest Hit Housing Markets, or Hardest Hit Fund (HHF). In the five years that followed, Florida not only performed below the state’s housing finance agency’s expectations, but also below the standards set by the other 18 participating agencies.

When the program began, the Treasury charged each participating agency with the tracking of progress towards each program’s individual goals, and in 2011, Former Treasury Home Preservation Office Chief Phyllis Caldwell told SIGTARP that the Treasury itself was capable of evaluating the success of HHF in ways such as “are we reaching the right number of people, are we reaching them in a sustainable way.”

SIGTARP’s audit makes the case that five years in, the program has underperformed, and lacks the necessary oversight by both the Treasury and Florida’s housing finance agency (HFA).

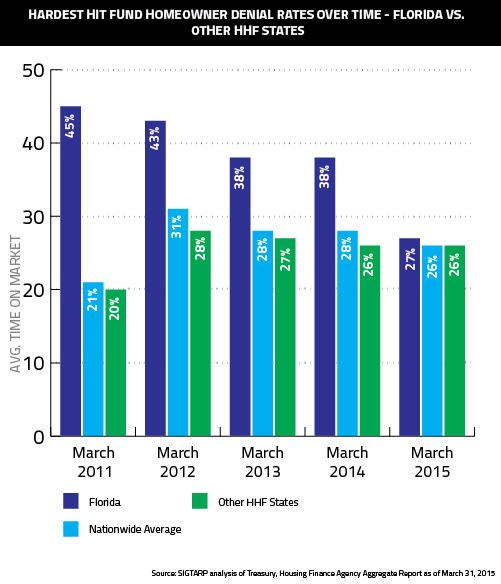

According to the audit, HHF Florida has fallen short of reaching homeowners in need of assistance in several ways. The state’s program has the lowest homeowner admission rate of any participating state, which SIGTARP says is a result of the Treasury lacking target homeowner admission rates.

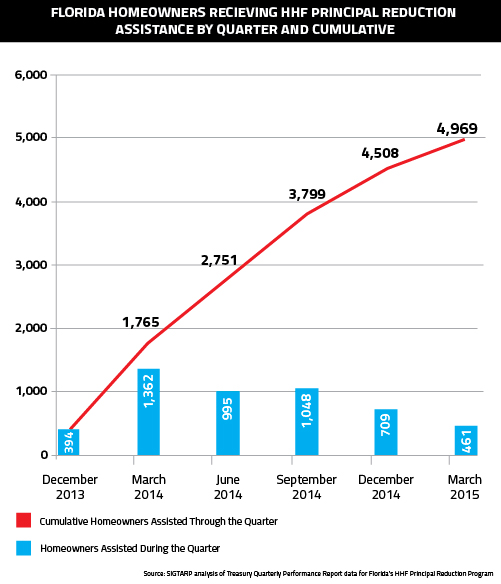

Only 20 percent of homeowners who applied for assistance have been approved – far below the 48 percent average among other HHF states. Cumulatively, less than 5,000 people have received assistance over the last five years.

SIGTARP also found Florida had one of the highest denied application rates – consistently above the average, for which the Treasury has provided no transparency on why the particular homeowners were denied.

Shortcomings Aplenty

The inspector’s report went on to outline a litany of shortcomings of the program’s overseers, including:

- Abnormally high withdrawal rates – as of March 2015, nearly 40 percent of all homeowners who applied to HHF Florida either withdrew their application or had it withdrawn by the state’s housing finance agency.

- Extended application process times – a median of nearly 6 months – resulting from a lack of a Treasury-set target for how long the state should take to process applications.

- No programs within HHF Florida to target underwater homeowners – a primary purpose of the program – for three years after it began.

- A failure to identify and mitigate obstacles for senior citizens with reverse mortgages that would keep them from properly applying. This has reportedly resulted in 46 percent of all senior applicants having their applications withdrawn.

SIGTARP has long claimed that Florida’s HHF is mired with problems. In the first two years of the program, nearly half of all homeowners applying in Florida were denied as ineligible. When the inspector’s office released its 2012 report, it called out program inefficiencies and failures. As a result, Florida’s HFA voted to eliminate certain eligibility requirements that accounted for approximately half of all denials.

Christy Goldsmith Romero, the special inspector general, said in a statement that Florida’s HHF’s poor numbers over the course of its lifespan were “not good enough for an emergency crisis program.”

Program’s Failure Not a Consensus

In its report, SIGTARP proposes a series of 20 recommendations to improve performance that included, among others, the Treasury establishing concrete targets for homeowner admission rates, reassessing and refining eligibility requirements within the next 60 days, and a number of measures to assure continued, proper analysis of the program.

But not all agree that the program is failing.

In an interview with the Miami Herald, spokeswoman for the state’s housing finance agency Cecka Green criticized the audit, telling the news source the negative findings did not acknowledge recent reforms to Florida’s program and displayed “a fundamental misunderstanding of the HFF program in its totality.”

The reforms, she explained, are responsible for increasing the program’s reach and, in effect, increasing its spending. While Florida’s HHF spent only $110 million helping homeowners battle foreclosures during the program’s first three years, since 2013, spending has increased to more than $411 million.

In a letter Treasury Department Official Mark McArdle wrote to auditors, he reaffirmed Green’s comments on the state’s reforms.

“Florida has been at the vanguard of (the program) in many ways,” he wrote, noting that in addition to the program’s improved performance, no evidence of waste, fraud or abuse was presented in the audit.

SIGTARP’s audit largely focused on what the Treasury could do to better ensure Florida’s performance, but McArdle clarified that states are given license over how to manage the program, and further suggested mandatory approval and denial rates would “run counter” to the program’s design.