In its last reading before the end of the year, the National Association of REALTORS® (NAR) Pending Home Sales Index beat expectations in a sign that buyers are taking advantage of increased inventory and no longer waiting for mortgage rates to fall.

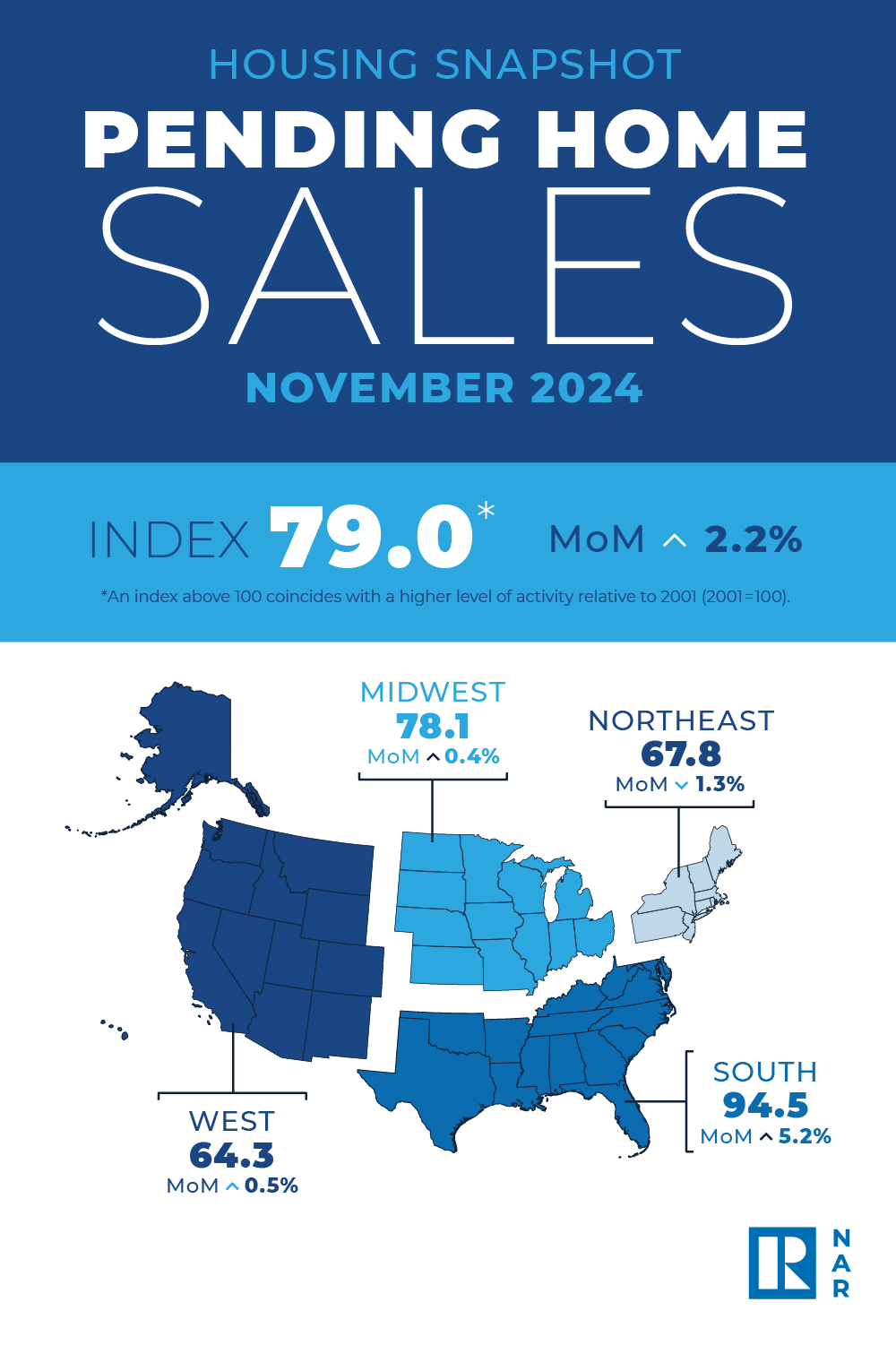

Specifically, the index rose 2.2% month over month in November, compared to a consensus estimate of economists for a smaller 0.7% gain. The increase also marks the fourth monthly gain in a row and the highest reading since February 2023.

“Consumers appeared to have recalibrated expectations regarding mortgage rates and are taking advantage of more available inventory,” NAR Chief Economist Lawrence Yun said. “Mortgage rates have averaged above 6% for the past 24 months. Buyers are no longer waiting for or expecting mortgage rates to fall substantially. Furthermore, buyers are in a better position to negotiate as the market shifts away from a seller’s market.”

Pending sales, in which the contract has been signed but the transaction has not closed, are considered a leading indicator and generally precede existing-home sales by a month or two. Year over year, sales were up 6.9%.

“On a regional basis, pending home sales increased month over month in the South, West and Midwest but declined in the Northeast,” First American Deputy Chief Economist Odeta Kushi said. “We find the strongest supply surges in Southern and Western markets but more muted improvements in the Northeast and Midwest. Where supply surges, improving affordability often follows, which may bring buyers off the sidelines, unlocking pent-up demand and reinvigorating market activity in the new year.”