One of the biggest hurdles facing residential builders is raising awareness of their projects among prospective buyers, according to Zillow’s recently released new-construction consumer housing trends report.

“Among new-construction buyers who didn’t initially consider newly built homes, 71% cite not being aware of any in their desired location as a reason why,” the report said.

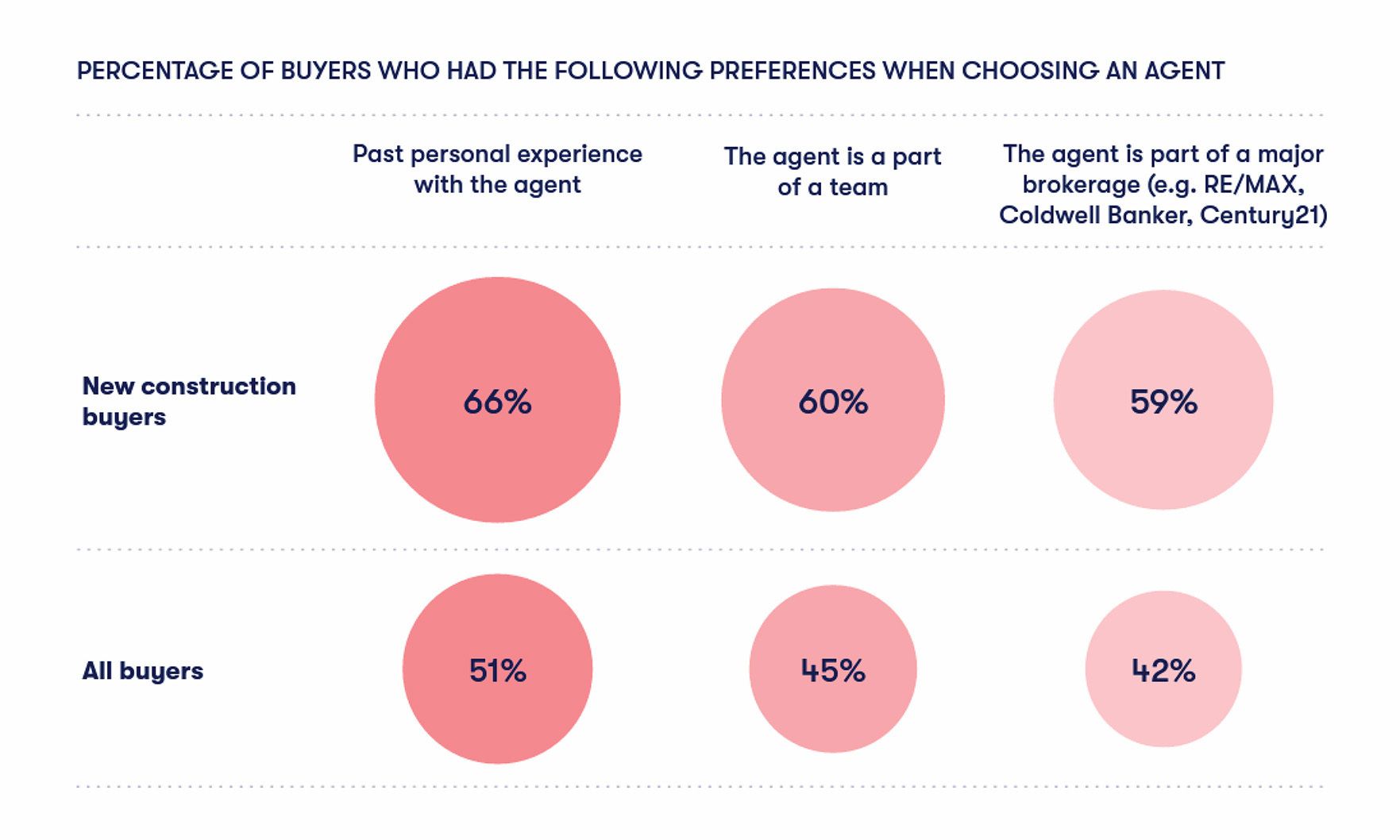

Clearly, marketing and raising project awareness are essential for builders and agents selling new construction. The study also found that virtual home tours and customization are more important than ever. Another key takeaway from the report is that buyers of new-construction value agents who are affiliated with major brokerages more than the typical homebuyer does.

Today’s new-construction buyer

The demographic profile of the new-construction buyer has not changed much in recent years, Zillow reported. That buyer is typically 44 years old and married or partnered, with a median income of $110,000. Beyond that, though, the preferences among new-construction buyers have evolved. It starts with the importance of customization.

“One reason new-construction homes continue to compete well against existing homes is buyers’ desire to customize their home before it’s built,” the report said. “That desire increased in 2022. In fact, 35% of new-construction buyers said they intended from the start of their search to buy a home they could customize during construction, a surge of 10 percentage points from 2021.

“This year, 44% said they planned at the outset to buy a completed home, while 21% sought out a home already under construction they could customize. The rising enthusiasm for customization may be the biggest trend uncovered among new-construction buyers this year.”

Another change is the willingness among new-construction buyers to look for a fresh home within existing communities, rather than solely in newly built neighborhoods.

In 2020, 23% of new-construction buyers purchased within an existing community. That percentage increased to 30% in 2021 and 33% last year.

“For some buyers, new-construction conjures images of dream homes lined up next to each other in a suburban development built from scratch,” the report said. “Over the last few years, the data is trending away from that vision.”

Buyer preferences

The Zillow report found that new-construction buyers gravitated to experienced agents with ties to teams and large brokerages more than the typical homebuyer did.

About 60% of new-construction buyers preferred to work with an agent on a team, and 59% preferred an agent who is part of a “major brokerage.” Among all buyers, those percentages were just 45 and 42, respectively.

“When it comes to new construction, buyers need trust and credibility throughout the process. According to the data, they may even care about it more than other types of homebuyers,” the report said. “Given the complexities of new construction, perhaps some buyers are hesitant to sign on with agents working solo.”

New-construction buyers also were more likely than all buyers to prefer a digital home tour compared to an in-person one. Forty-three percent of homebuyers looking at new construction prefer 3D tours to in-person viewings. Only 20% of people looking at existing homes prefer a 3D tour.

How new-construction buyers purchase their home varies greatly from buyers of existing homes.

“New-construction buyers are 35% more likely than existing homebuyers to be selling a home they already own,” Zillow Senior Economist Jeff Tucker said.

Zillow reported 32% of new-construction buyers saved for their down payment over time; 28% used money from the sale of a previous home; 19% used sale of stock or from a retirement fund; and 14% relied on a loan from friends or family.

New-construction buyers relying on equity from a prior home sale present a double-edged sword for builders, Tucker said.

“Those buyers should have substantial equity from their home value’s recent rise, but they may not be able to sell as quickly or easily as they hoped,” Tucker said. “They’re also likely to get some sticker shock at mortgage rates, which could be twice what they’re currently paying.”

Deliver what buyers seek

To meet the demands of today’s new-construction buyer and maximize sales, builders and agents should focus on three things, the report noted.

First is customization. If buyers are prioritizing custom amenities and layouts, builders and agents should highlight those options. “Communicate those possibilities early and often during the sales process. This will give buyers more say in their purchase, which could lead to more commitments,” the report said.

Second is location. The data shows buyers are more and more comfortable with new construction in older, established neighborhoods. Make sure potential buyers are aware of those options.

Third is to offer contract contingencies.

“The median sales price for newly built homes costs roughly $60,000 more than the median sales price for existing homes,” the report said. “As a result, homeowners may decide to delay buying their next house because they’d lose their comparatively lower mortgage rate if they moved. Builders that provide a rate buy-down combined with flexible financing and sale-of-existing-home contingencies might tempt them off the fence and into a new-construction home.”