Eighteen percent of millennials — approximately one in five — believe they will never become a homeowner, according to a recent survey from Redfin. Twelve percent of Gen Zers responded the same way.

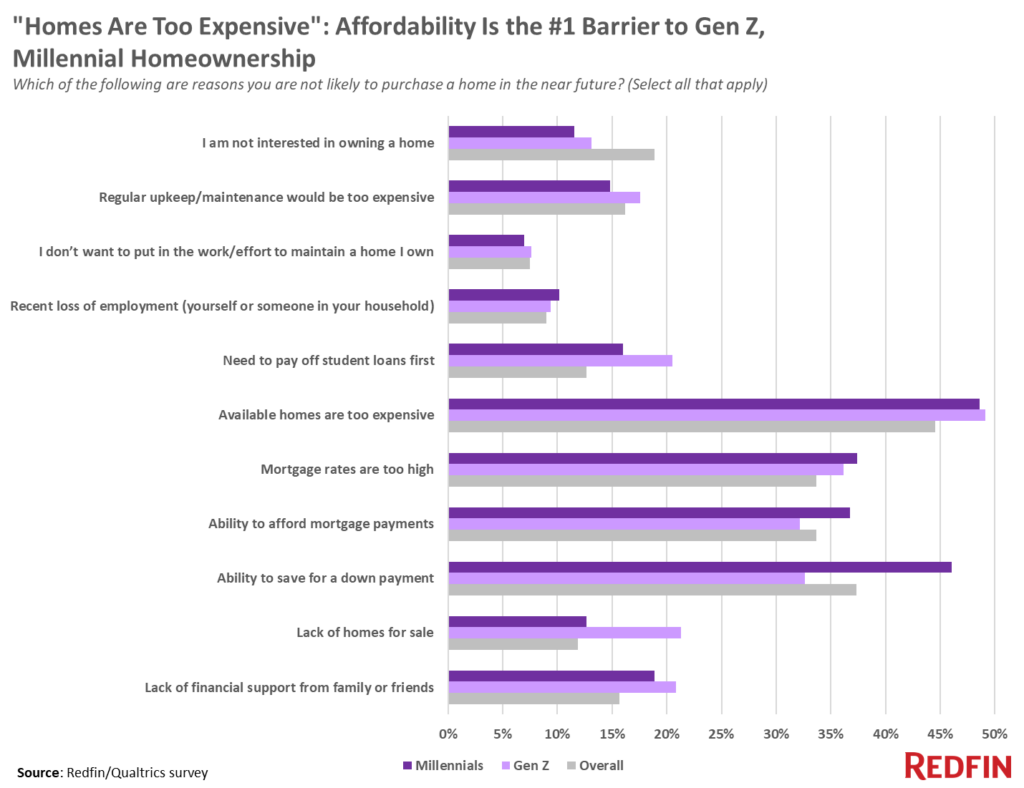

Roughly half of all millennial and Gen Z respondents said high housing prices are their biggest roadblock to homeownership, followed by several other affordability-related factors.

Saving for a down payment was a barrier for 46% of millennials and 33% of Gen Z respondents. Over a third of both generations also say high mortgage rates presented a huge financial roadblock. Furthermore, 21% of Gen Zers and 16% of millennials say they’d need to pay off their student loans before purchasing a home.

“The worsening housing affordability crisis has an outsized impact on Gen Zers and millennials because they’re much less likely to own a home than older generations,” said Redin Chief Economist Daryl Fairweather. “That means many young Americans don’t benefit from rising home prices by gaining equity. Instead, these would-be first-time homebuyers bear the burden of high prices, high down payments and high monthly mortgage payments, without profits from a previous home to offset the cost.

“Many young people don’t have a choice between renting and buying,” Fairweather continued. “They’re renting because even though rent payments have increased too, it’s still more affordable than buying in much of the country — and renters don’t need a down payment.”

Only 26% of Gen Z adults own a home, while roughly half of millennials own a home. By comparison, 71% of Gen Xers and 79% of baby boomers own their home.

Among millennials and Gen Z respondents who do plan on purchasing a home in the near future, 40% said they’ve picked up a second job in order to pay for their down payment. A smaller proportion of respondents — roughly a quarter — said they planned on receiving a cash gift from family to assist with a down payment or planned on using an inheritance.