As the post-pandemic market continues to shift, agents are shifting, too — often to other brokerages. The first quarter of 2023 shows some serious agent fluctuation at many of the country’s biggest brokerages.

A recent report by local real estate tech strategist Mike DelPrete illustrates the changes. To determine where exactly agents are flocking to, and from, DelPrete looked at data from some of the biggest brokerages in the country: Anywhere, Compass, Keller Williams, eXp Realty, Redfin, Real, RealtyOne, RE/MAX and United Real Estate.

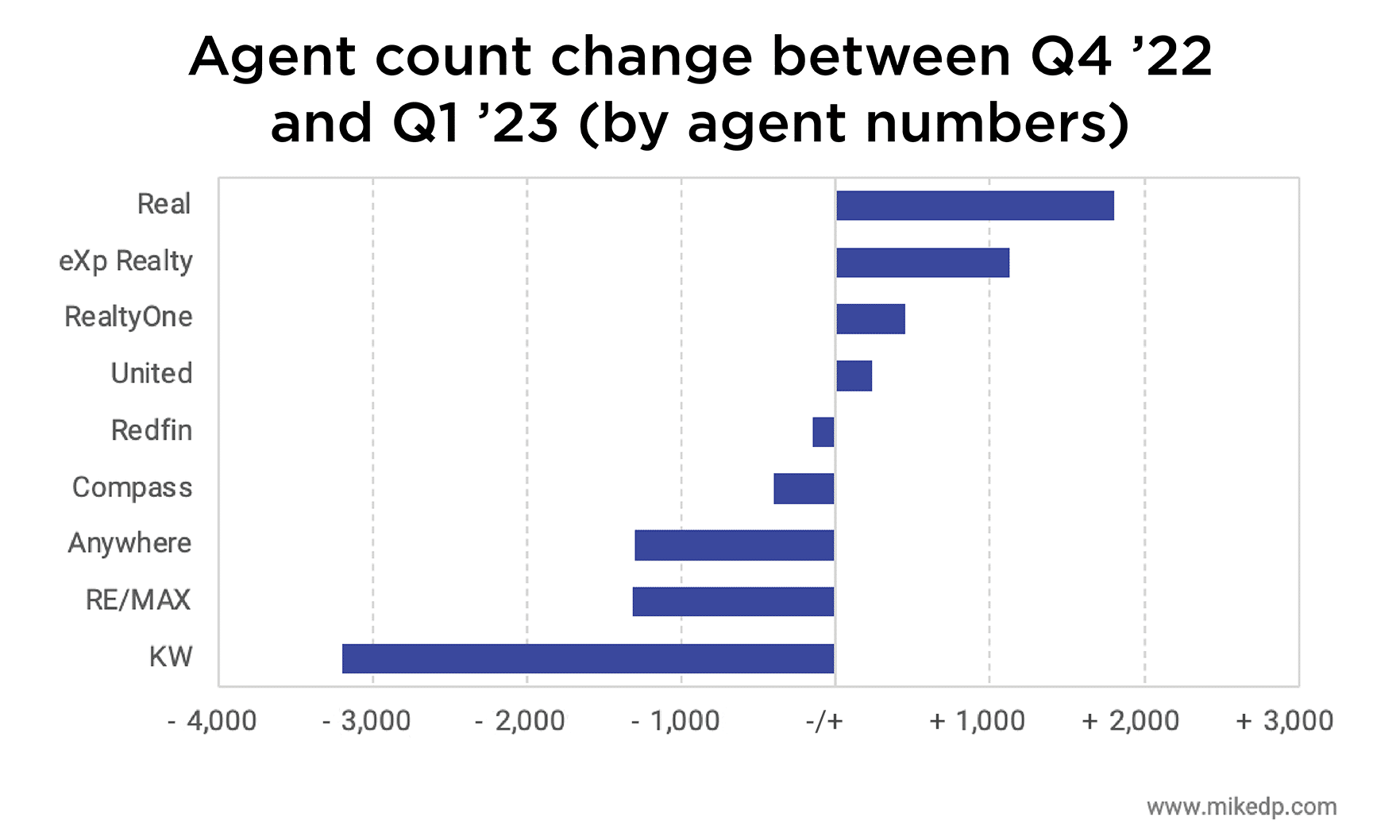

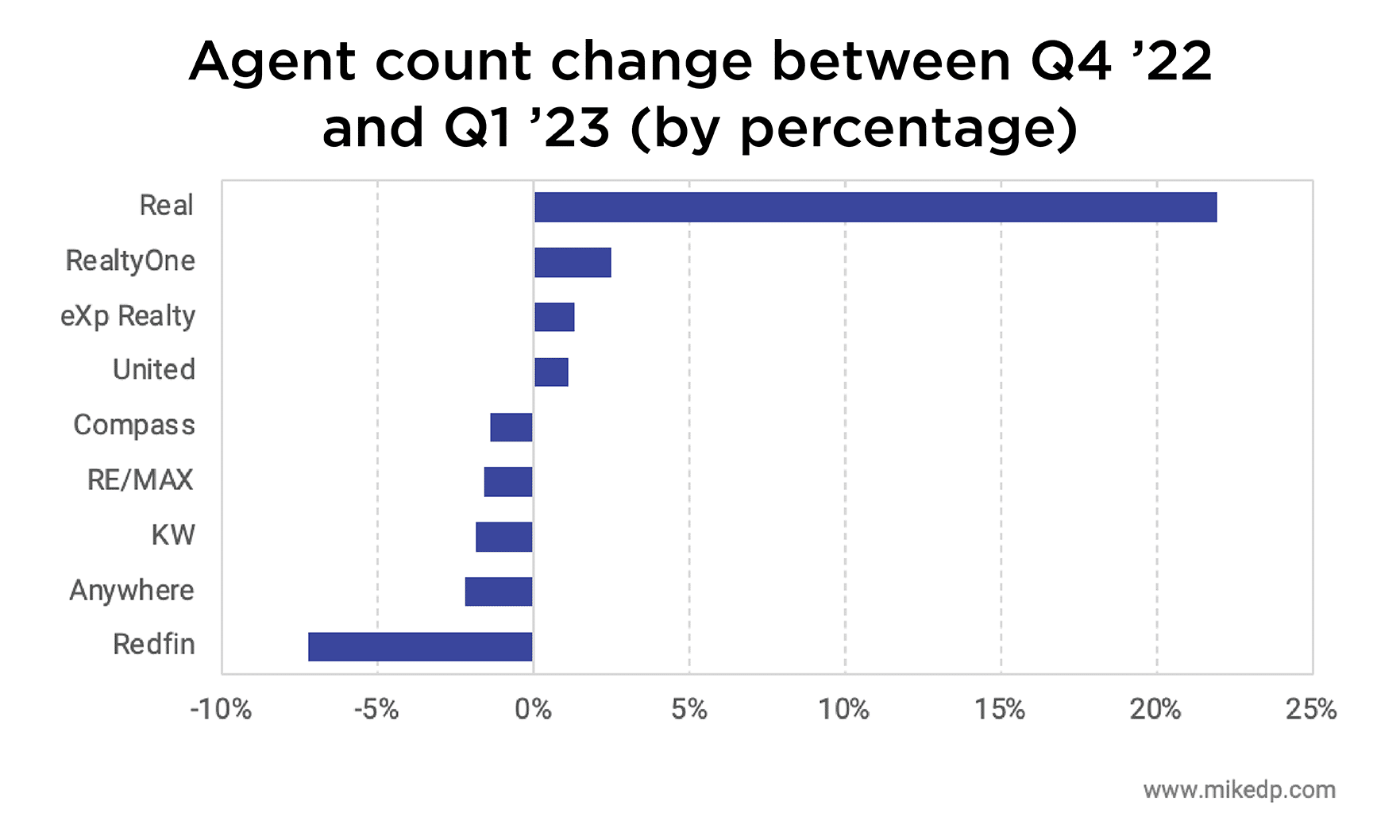

Among them, the five largest brokerages — Anywhere, Compass, eXp, Keller Williams and RE/MAX – now employ just over 427,000 agents, which is down 1.1% from the previous quarter. And three of those five major brokerages accounted for the loss: Keller Williams, RE/MAX and Anywhere.

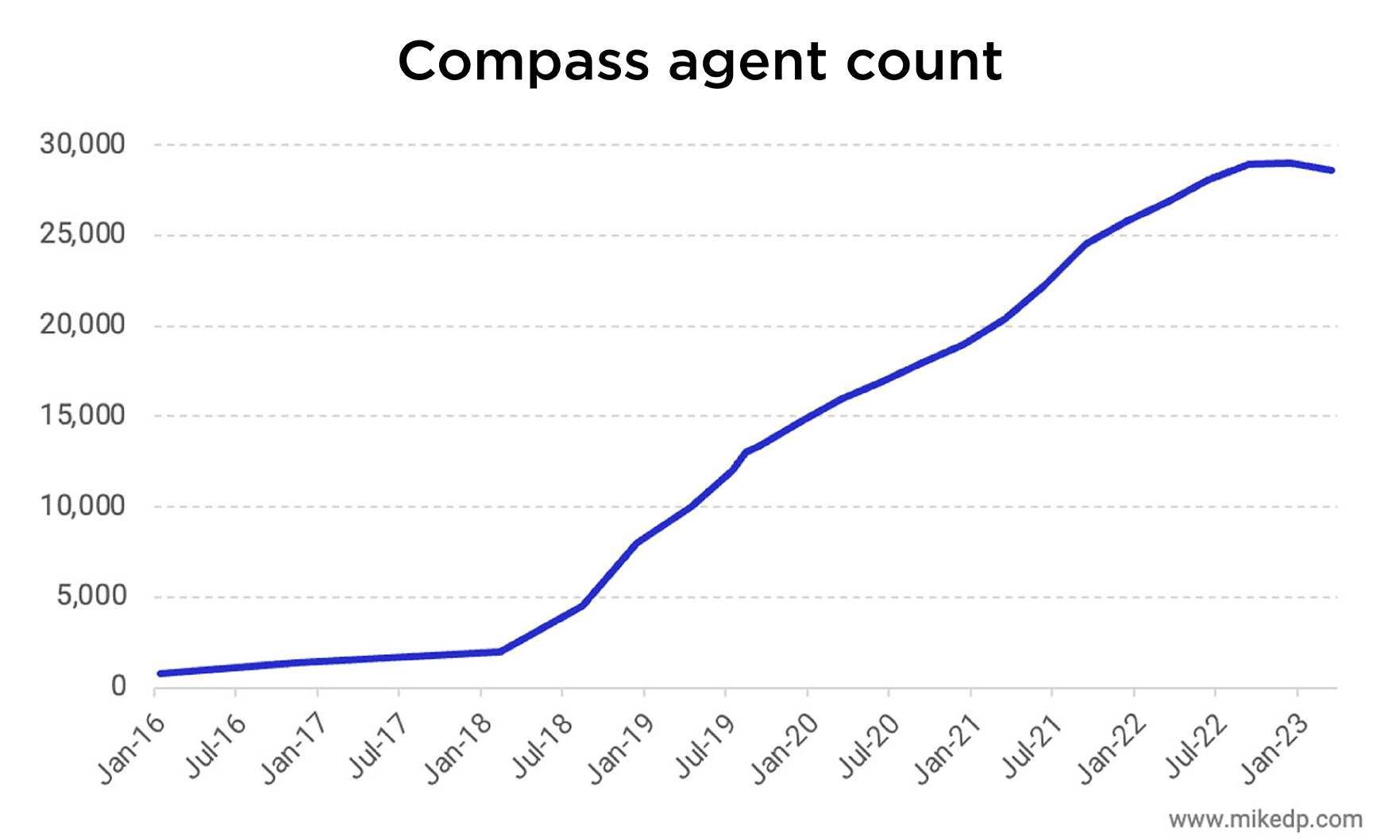

Compass and Redfin also showed losses, as the current employee count reflects recent layoffs. After three rounds of layoffs, Redfin now has fewer than 2,000 salaried principal agents. Similarly, Compass announced its third round of layoffs at the start of Q1, which became the first quarter that the brokerage lost agents. In an attempt to cut operating costs by 40%, Compass now counts 28,000 agents.

Meanwhile, younger, low-fee brokerages like eXp, Real, United and RealtyOne all added agents during the first three months of 2023, with Real leading the pack. During Q1, the cloud-based company hired nearly 2,000 new agents. That’s especially notable for Real, where the bump represents a 20% agent increase, bringing the total count to roughly 10,000.

Though that number is dwarfed in comparison to other firms on the list, like Anywhere and RE/MAX, which employ 58,000 and 82,000, respectively, it’s proof that Real is fast catching up with previous industry disruptors like Compass.

That’s why, as a primary reflection of brokerage growth, agent retention remains a key indicator in predicting the state of the industry. “Agents — not AI, machine learning, a sophisticated CRM … nor any other tech buzzwords — sell houses,” DelPrete says. “To identify the brokerage business models of the future, one simply needs to follow the agents.”

And while real estate transactions slow down, his report shows that agents are distancing themselves from more traditional brands in favor of newer models — with higher commissions.

Zooming out further, new numbers from the National Association of REALTORS® show that membership was down 0.66% year over year in April but up .69% month over month. Currently, the association has 1,537,418 members. With Realtor membership looking relatively stable, agent migration is a pivotal snapshot of where the industry is headed.