In 2022, the housing market boom in 2021 propelled by historic low mortgage rates and a COVID-induced demand has shifted to a cyclical downturn with mortgage rates skyrocketing to the 7% mark. While sales have contracted amid rising mortgage rates, home sales prices are still rising at double-digit pace due to a continued shortage of homes for sale. In 2023, slower interest rate hikes as inflation cools and the Miami metro area’s attractiveness as a destination for businesses and domestic and international movers provide the backdrop for a stronger housing market. The sharp erosion in home affordability and slow recovery in supply will continue to temper the recovery in home sales in 2023.

South Florida Market Projected to Outpace Pre-Pandemic Levels

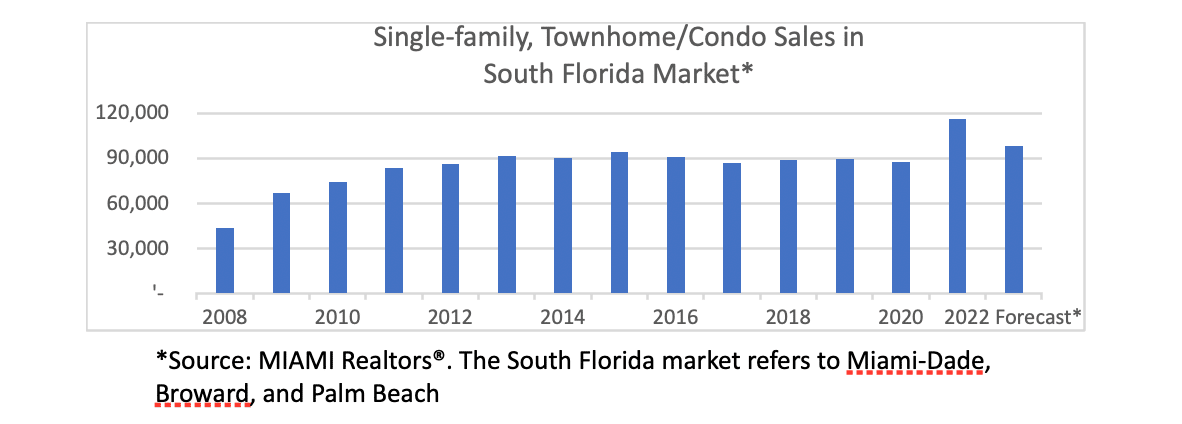

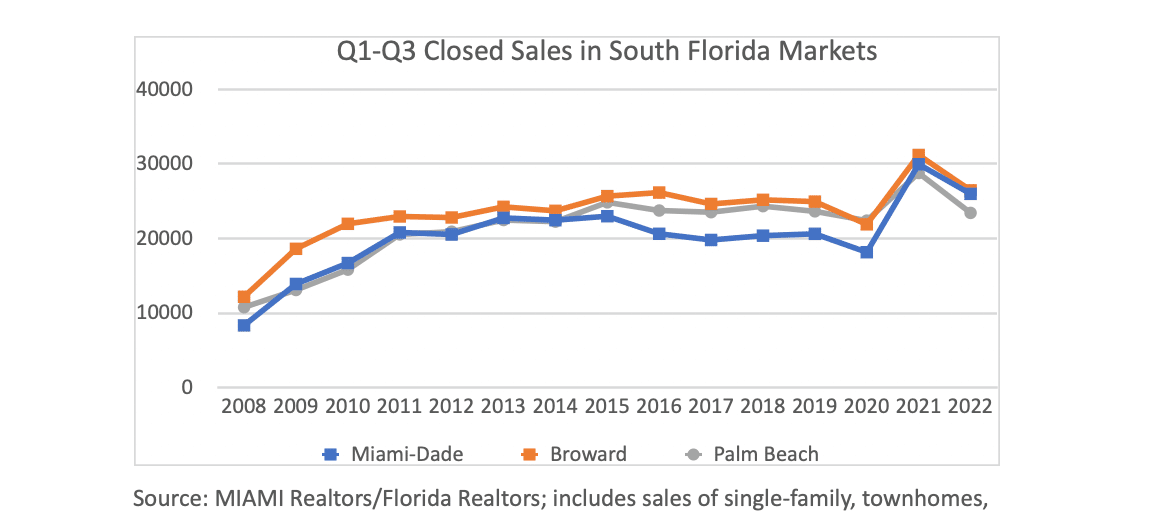

As of the first three quarters of 2022, closed sales in the South Florida counties of Miami-Dade, Broward and Palm Beach contracted by 16% compared to the level in the same period in 2021, slightly more than the 13% drop in the Florida market.

However, sales are poised to outperform the level in 2019 and will be the second highest level since 2008. This is because the combined closed sales in the South Florida counties of Miami-Dade, Broward and Palm Beach during the first three quarters of 2022 exceeded sales over the same period since 2008. If the pace of increase in the third quarter is sustained in the fourth quarter, sales are projected to hit about 98,000 for the full year, the second highest level since 2008.

Home Prices Still Rising at Double-Digit Pace Under Continued Supply Shortage

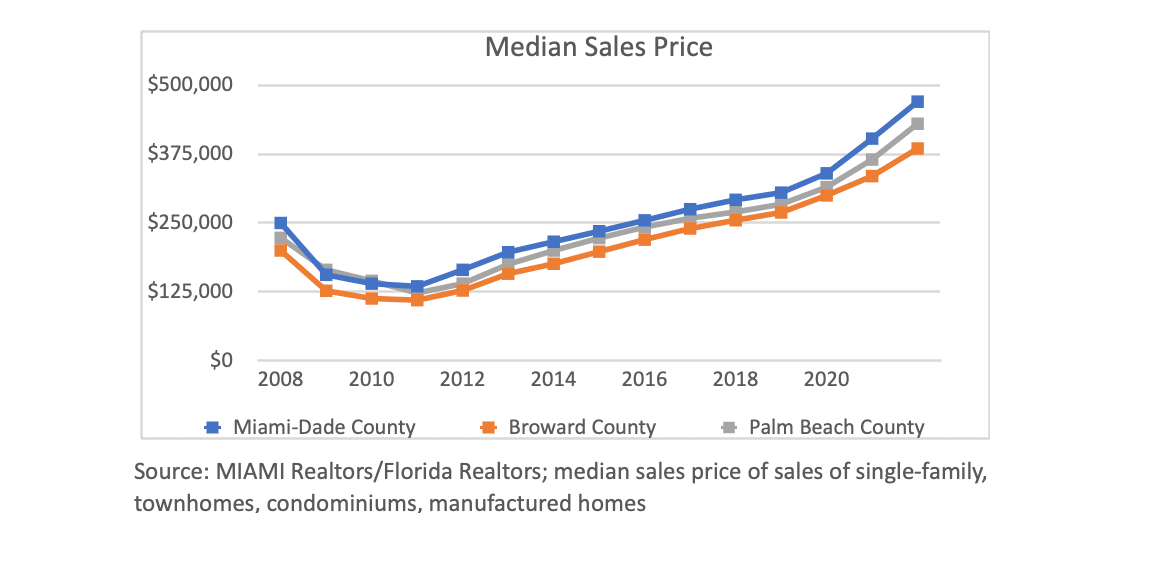

As of September, the median sales price of all properties sold in the Miami-Fort Lauderdale-West Palm Beach metro area was up 15.2% year-over-year, slightly outpacing the 14% price appreciation in overall Florida sales. Moreover, the pace of price appreciation in the South Florida markets has decelerated to a lesser extent than in the overall Florida market where the pace of price appreciation slowed from 19% in 2021 to 14% as of September 2022.

The strongest price appreciation is in Palm Beach County, with the median sales price of all home sales up 18% year-over-year as of September 2022 (16% in full year 2021). In Miami-Dade County, the median sales price rose at a strong yet more modest pace of 16% (19% pace in full year 2021). In Broward, prices were also still rising at a strong yet slower pace of 10% year-over-year as of September (12% pace in full year 2021).

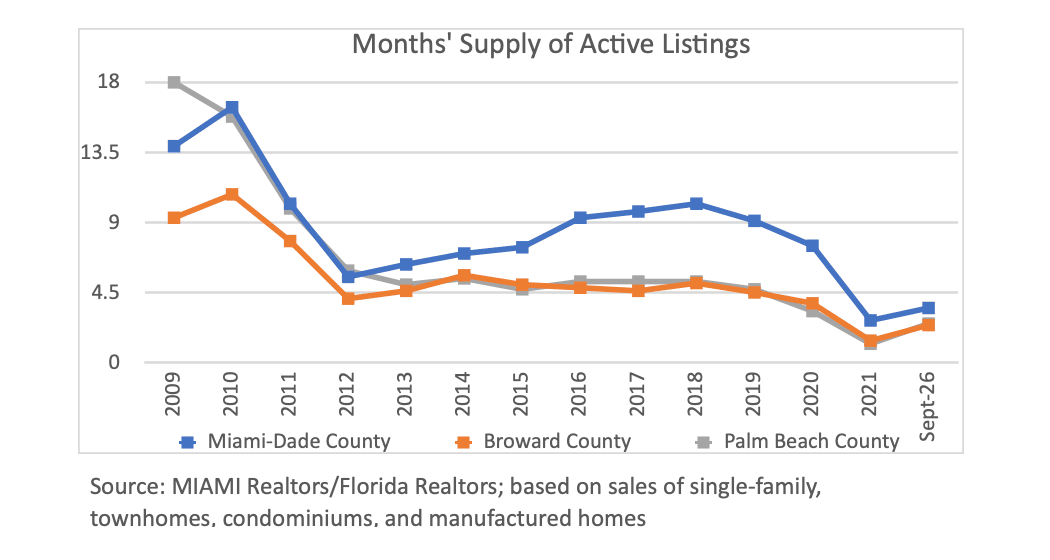

The reason home prices have not buckled under slowing demand is due to the continued shortage of homes for sale relative to demand. Active listings are still below the six month’s supply norm and below pre-pandemic levels. In Miami-Dade County, active inventory as of the end of September increased to 3.5 months’ supply of demand (2.7 months in 2021) but this is a tight level of supply compared to 2019 (9.1 months’ supply). In Broward and Palm Beach, active listings rose to 2.5 months’ supply as of the end of September (1.4 and 1.2 months’ supply in 2021, respectively) but remain below the 2019 levels (4.5 and 4.7 months’ supply, respectively).

Strong Job Growth and Domestic and International Migration Bolster Housing Demand

Strong employment conditions have bolstered housing demand in South Florida. In September, the Miami-Fort Lauderdale-West Palm Beach metro area had the sixth-lowest unemployment rate of 2.3% among metro areas with at a population of at least 1 million. This is lower than the unemployment rate of 2.5% in Florida and 3.5% rate nationally.

Over the period July 2020-July 2021, Florida had the largest net domestic in-migration, with 259,480 people moving into the state, outranking Texas (197,500). Florida also led the nation in terms of international movers, with 38,600 people moving from abroad. Florida has been the top destination of foreign buyers, accounting for 24% of all foreign buyers purchasing U.S. property, according to the National Association of Realtors® International Transactions in U.S. Residential Real Estate. The Miami-Ft. Lauderdale-West Palm Beach metro area takes in about half of Florida’s foreign buyers, according to the Profile of International Residential Transactions in Florida.

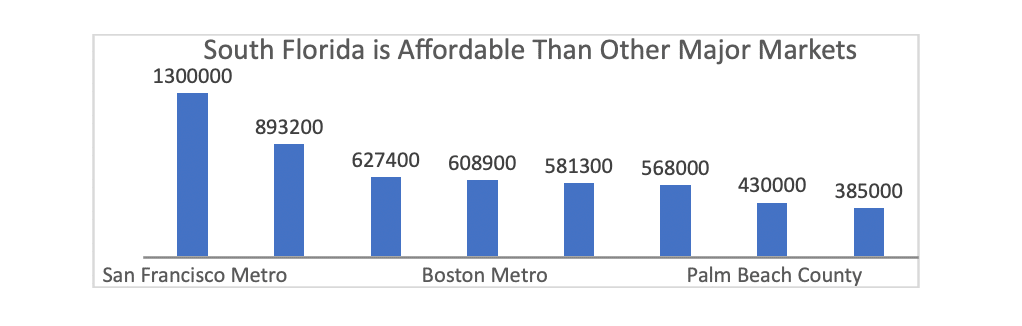

The South Florida market remains more affordable compared to other major metropolises, and this has tended to attract businesses to the South Florida market. As of September, the median single-family home price was lower in Miami-Dade County ($568,000) compared to major markets like San Francisco ($1.3 million), Los Angeles ($893,200), New York-Jersey City ($627,400), Boston ($608,900), Denver ($ 666,600) and Washington, D.C. ($581,300).

Slower Interest Rate Hikes to Bolster Housing Demand in 2023

Improving economic conditions marked by slower inflation and the flattening of interest rate hikes and Florida’s attractiveness as a destination for businesses and domestic and international movers provide the backdrop for a stronger housing market in 2023.

While interest rates are still expected to rise in 2023, interest rates are not expected to ramp up as they did in 2022 as the Federal Reserve implemented a series of rate hikes (375 basis points total) to put inflation under control (inflation has indeed started to cool from a peak of 9.1% in June to 7.7% in October). The Federal Reserve Board members expect a federal funds rate of 4.6% to be an appropriate policy rate in 2023 to bring inflation under control. The 30-year fixed mortgage rate is currently at 7.1%, which means that mortgage rates are likely to rise to 7.5% by 2023. Under this monetary policy, the Federal Reserve Board participants expect the economy to grow by 0.5% to 1.5% in 2023. Growth could be stronger as the economy had already expanded by 2.6% in the third quarter.

The modest uptick in interest rates in 2023 bodes well for a pickup in sales. House prices did not collapse under the weight of the series of interest rate hikes in 2022, so home prices are not likely to decline in an environment of a modest increase in interest rates in 2023.

Rising mortgage rates have eroded home affordability, but more so in expensive markets. South Florida’s relatively affordable market and business-friendly environment will continue to draw businesses and workers to this market. The shift toward hybrid and remote working will tend to bolster demand in more affordable South Florida submarkets like Broward County.

Gay Cororaton is the chief economist for MIAMI Realtors®.