Mortgage rates rose quickly last week. The 30-year fixed mortgage rate hit 3.01%, up 0.13% from the week prior. But this is all keeping in line with the 10-year Treasury yield trend, according to the National Association of REALTORS®.

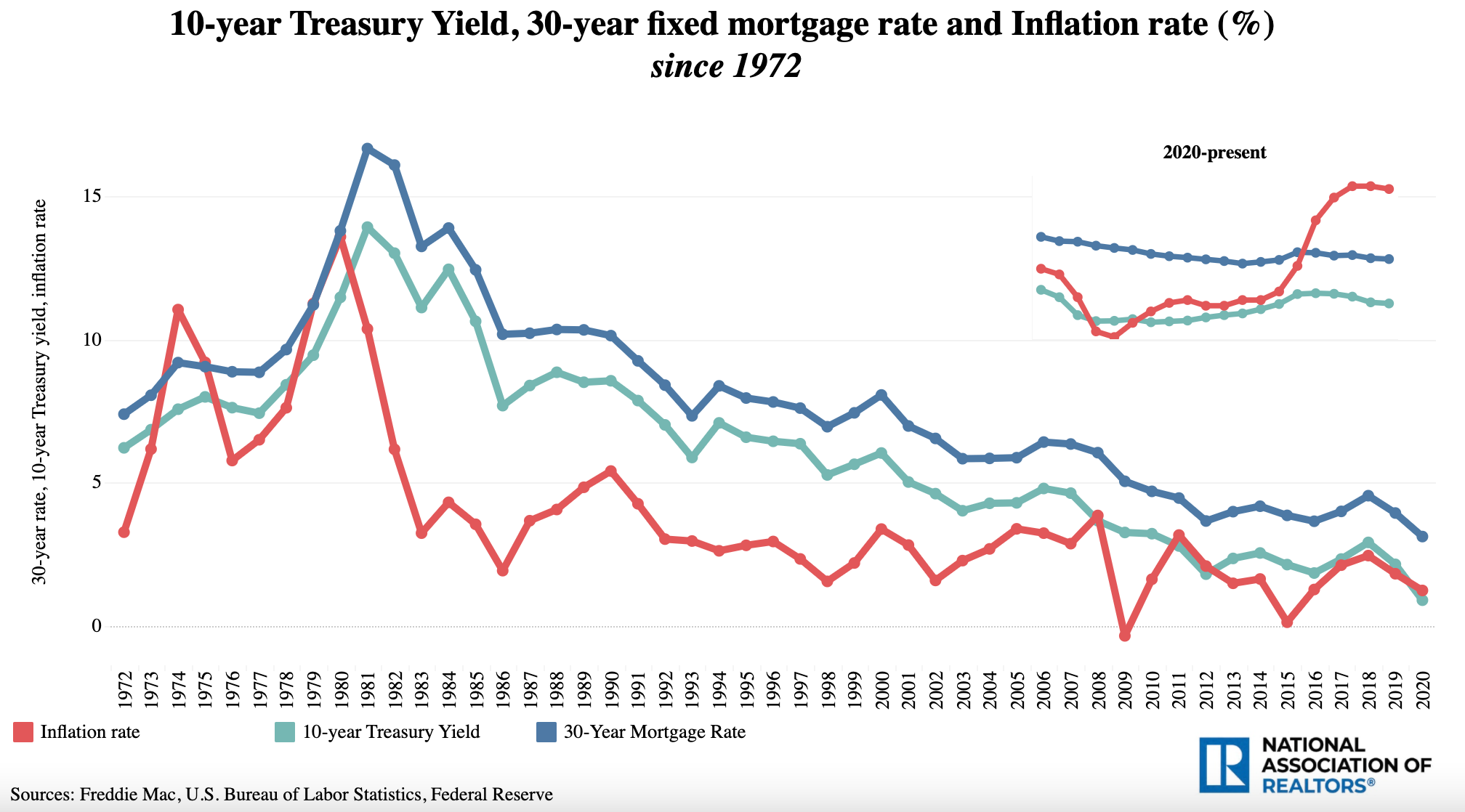

As NAR points out in a recent report, historically, inflation causes the 10-year Treasury yield to trend upward. As rising inflation erodes investors’ returns on bonds, bonds decrease in value — and yields rise. In turn, mortgage rates rise. That corresponding relationship between inflation and mortgage rates is illustrated in the graph below, from NAR.

However, inflation rose past the 2% mark back in April 2021. And while it’s taken some time for mortgage rates to catch up, now, it seems those rates within the 2% range have come to an end. Still, rates are uncommonly low.

By mid-2022, NAR predicts that the rate for a 30-year fixed mortgage will reach 3.5%.