National Rent Report Miami rental and sales prices exploding. 📸: Zumper

The dramatic rise in rent that’s come to define 2021 accelerated in July, with Zumper’s National Rent Index rising 7% year over year for one-bedroom apartments and a staggering 8.7% for two-bedroom apartments.

For context, the Zumper National Rent Index rose at a steady 1% clip during most of 2020, while it was mostly flat in 2019.

Some of the metro areas that have experienced the most growth include Phoenix, Miami, Atlanta, Dallas, Orlando, San Diego, and Tampa Bay.

The median rent price in Miami is up 5.3% to $1,790 for a one-bedroom apartment and up 4.9% to $2,360 for a two-bedroom. According to a report by the National Low Income Housing Coalition, an hourly wage of $28 per hour — or $58,240 annually, assuming a 40-hour workweek for 52 weeks a year — would be enough income to rent a two-bedroom apartment.

Higher rents usually mean great opportunities for first-time homebuyers and agents; but, the region is undergoing record-breaking sales and price growth. Miami-Dade County in June saw the highest number of residential sales in a single month in nearly 30 years. It’s a strong indicator of the increasing demand for South Florida living.

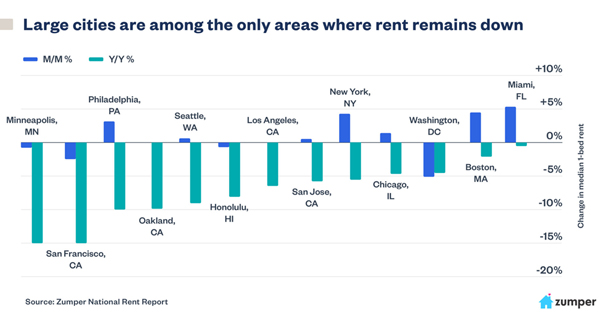

National Rent Report large city comparison. 📸: Zumper

Miami-Dade recorded 4,057 condo and single-family home sales, according to the latest Miami Realtors Association sales reports released last week. It is the most sales the county has had in a single month since the association started tracking sales activity in 1993.

At the same time, median sales prices rose for houses by 28.7% when comparing June 2020 to June 2021 — from $388,500 to $500,000 — and by 29.8% for condos — from $262,000 to $340,000.

Florida famously has no state income tax and the state’s population has steadily grown since 2015, adding 1.7 million inhabitants, according to the state’s November 2020 Demographic Estimating Conference. The net growth is accelerating as Northerners, Midwesterners and Californians move from their high-tax states — and not many Floridians are leaving. Florida Realtors economists predict there will be an additional net 1.4 million Floridians by 2025.

Rent or buy? What’s a consumer to do? The population increase and sales and rental activity is causing low inventory and ever-increasing competition for anything that’s available.