It’s hard to say what the fallout of the COVID-19 pandemic will be for the industry, but real estate analyst Mike DelPrete is assuming it’ll last throughout the year. In a webinar conducted Friday, he predicted that the U.S. will see a 50% drop in transaction volume in 2020 compared to 2019’s numbers.

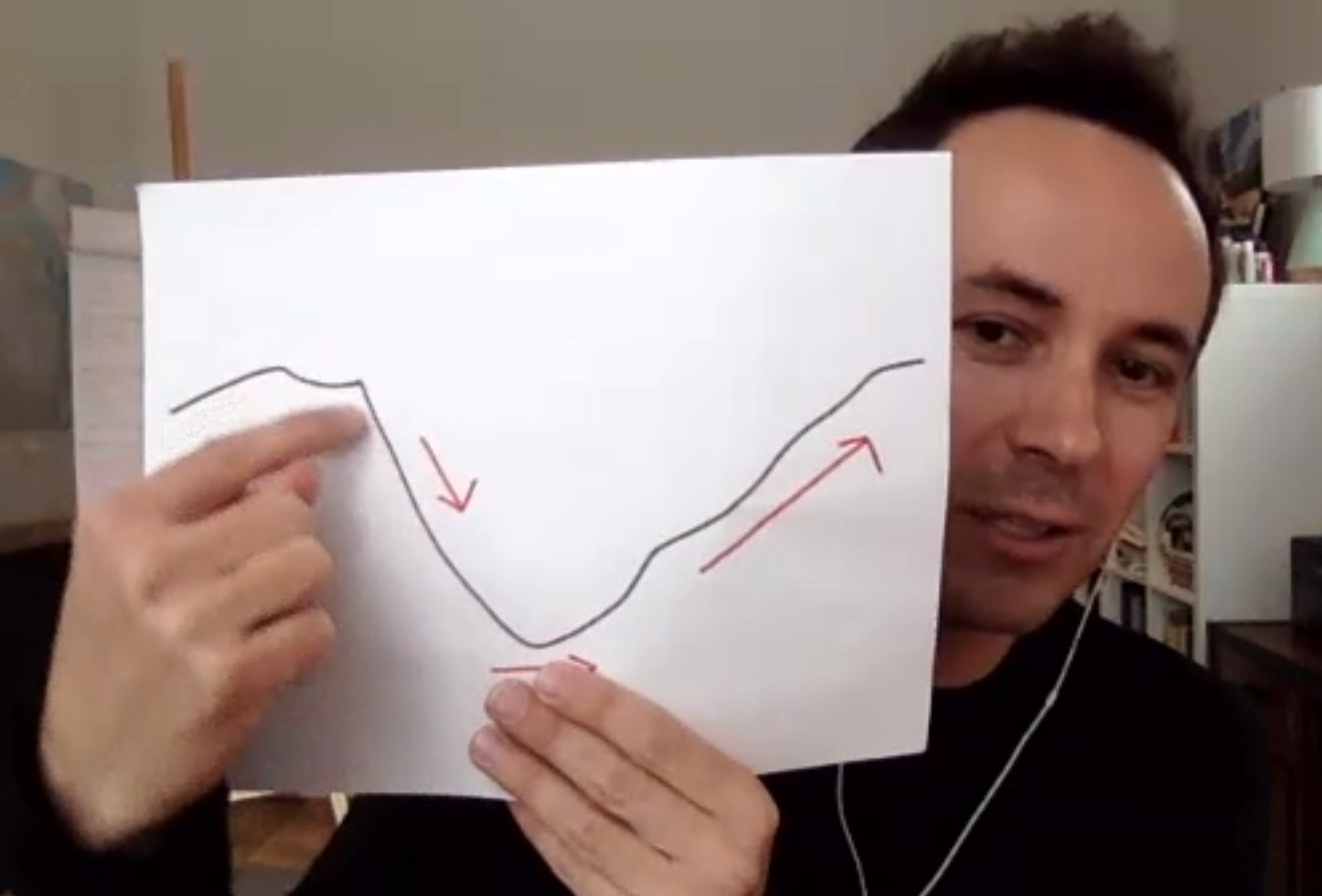

Mike DelPrete shows where most of the U.S. is in terms of the coronavirus pandemic’s impact on the economy.

“The pandemic is affecting different parts of the world at different times,” DelPrete, who also serves as a scholar-in-residence at the University of Colorado Boulder, said. He noted that examining what the market in China looks like now can give some indication of what things will look like stateside in a month or two. There, the market is still about 40% lower than what it would be normally, even though they’re entering a rebound phase. “That recovery is slow.”

But completed transactions are just one part of the story. To paint a more complete picture of what the real estate market will look like over the next year or so, it’s important to look at leading indicators such as search data and lead generation activity.

DelPrete noted that when the virus initially hits a market, there’s generally a 25% to 40% decrease in traffic to real estate portals as consumers figure out how to deal with “remain in place” orders and take care of immediate health needs. But then, the search activity tended to rebound.

“Once people get stuck inside and get used to this, they start browsing again,” he said. Still, DelPrete said the bounce-back in traffic hasn’t been translating to leads, with sites experiencing anywhere from 30% to 50% decreases in people filling out contact forms on these sites.

Perhaps more concerning is the fact that many of the individual leads that do remain aren’t as strong as pre-pandemic leads. “If I just have a question [about a property], am I as valuable as somebody who is interested in a transaction?,” DelPrete asked. “Just because they have questions doesn’t mean they’re able to transact.”

Of course, whether or not a person is able to buy or sell their home depends on local restrictions. If the area is under lockdown, is real estate still considered an essential service? Are there options that allow for virtual closings or remote notarization?

DelPrete said that this factor means the entire nature of lead generation may be shifting. “If people are in lockdown, the value of a lead is changing,” DelPrete said.

But even when the logistical issues have cleared, there could be lingering effects that cause leads to still be less valuable than they were before. “There’s this other question that’s equally important: Will people buy homes? … That speaks to the market uncertainty,” DelPrete said. “If folks are not willing to move, the value of a lead is less.”

DelPrete said that most companies running real estate portals recognize this, which is why they’re offering discounts to everybody who uses them. Sites like Zillow and realtor.com have a particular interest in keeping their broker clients happy. “They want them to be in business,” DelPrete said. “They want to help their customers out.”

One positive DelPrete noted is that this will be a time of reinvention in terms of brokerages and real estate technology. While many companies are working behind the scenes to create new technology that allows real estate to continue on when many aren’t allowed to leave home, the jury is still out on how this will impact the instant buyer industry.

“This will certainly stress test the iBuyer model,” DelPrete said. “How long can they keep paying the holding costs for the homes they own?”

While he was not surprised by the decision of many companies to suspend purchasing new homes under iBuyer programs, DelPrete did note that the pandemic overall might be a bolstering force for this new model in real estate sales. “iBuying has a certain appeal …

You don’t have to have a couple dozen strangers tramping through your house, coughing and sneezing,” he said. “Perhaps there will be more people who are interested in this.”

Whether you run an iBuying service, portal or real estate brokerage, DelPrete’s advice remained the same.

“Survival is everything… You’ve got to be around for the rebound,” he said, encouraging business owners to cut costs where possible and create a plan for accelerating business through the recovery phase. “The companies with strong balance sheets will survive.”